You ever toss your chips into the forex pot, heart thumping, only to realize you’ve got no clue what each pip’s actually worth? Yeah—been there. Trading without understanding pip profit is like betting on a horse and not knowing if it’s even in the race. On iq option forex, every tick matters—and knowing how to read those ticks can mean the difference between cashing out or crashing hard.

Pip math isn’t just for Wall Street wizards—it’s survival gear for anyone who wants skin in the currency game. Skip this step and you're walking blindfolded through a minefield. But once you learn how to count those pips properly? Boom—you’re steering your trades with purpose instead of holding your breath with crossed fingers.

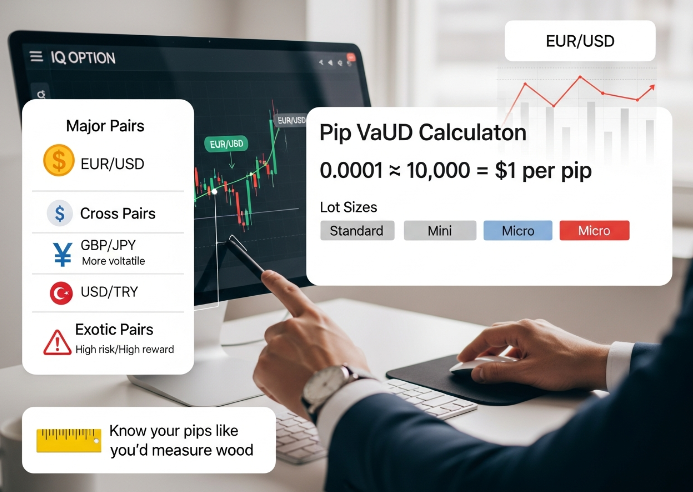

Understanding Pip Value: The IQ Option Forex Basics

Quick guide to pip values when trading forex on IQ Option. Mastering these basics helps you avoid rookie mistakes and tighten your trading game.

What is a Pip in Forex Trading?

• A Pip stands for "percentage in point"—it's the smallest unit of price movement for most currency pairs, typically the fourth decimal place.

• For most pairs, one pip equals 0.0001. But if you're trading JPY pairs, it's usually the second decimal place—0.01 instead.

• Traders track pips to measure price fluctuation, not just for fun but to calculate potential gains or losses precisely.

In short, understanding pips is like knowing inches when measuring wood—it’s basic, but you can’t build anything without it.

How to Calculate Pip Value in EUR/USD

Start with the standard pip size: 0.0001.

Multiply it by your lot size:

Standard lot = 100,000 units

Mini lot = 10,000 units

Micro lot = 1,000 units

Then multiply that by the current EUR/USD exchange rate.

Finally, convert it into your account currency if needed.

For example: If you're trading a mini lot and EUR/USD is at 1.1000 — pip value = 0.0001 × 10,000 = $1 per pip.

That’s how traders on platforms like Fxbee break down their profits before even clicking “Buy.”

The Impact of Currency Pair Types on Pip Value

• Not all currency pairs are created equal—each pair’s quote currency affects how much each pip move is worth in real cash.

Grouped by pair type:

Major pairs (e.g., EUR/USD): Stable and predictable; pip value remains consistent across brokers.

Cross pairs (e.g., GBP/JPY): More volatile; since JPY uses two decimals, expect different pip math here.

Exotic pairs (e.g., USD/TRY): Wild swings mean bigger risk—and possibly bigger rewards—but also unpredictable pip values due to wide spreads.

Exotic pairs generally show higher volatility than major currency pairs, which makes precise pip calculation even more important when you're using tools like iq option forex calculators or built-in profit trackers.

Understanding these differences makes sure you’re not flying blind when placing trades based on gut feeling rather than numbers that actually count.

4 Steps to Calculate Your Profit from Forex Pips

Quick math meets smart trading in these four steps—learn how to break down your forex gains with ease on IQ Option forex trades.

Step 1: Determine the Currency Pair and Pip Value

Understanding your currency pair is like knowing the rules of the game before you play. The base currency, the quote currency, and your lot size all play a role in figuring out how much each pip is worth. For example:

A standard lot (100,000 units) usually means each pip is worth $10.

A mini lot (10,000 units) gives a pip value of about $1.

A micro lot (1,000 units) drops that to roughly $0.10.

On IQ Option, this varies slightly based on your account settings and current exchange rates. Always double-check with their built-in calculator before placing trades.

Step 2: Analyzing Market Conditions: Uptrend or Downtrend?

Before jumping into any trade, get a feel for where things are headed.

• In an uptrend:

Price makes higher highs and higher lows.

Good time to buy if momentum holds.

• In a downtrend:

Lower highs and lower lows signal bearish pressure.

Consider selling or shorting positions.

Use candlestick patterns, volume spikes, and moving averages to confirm direction. On the IQ Option forex platform, indicators like RSI or Bollinger Bands can help clarify what’s going on under the hood.

Step 3: Using Take Profit Orders for Maximizing Gains

Set it and forget it? That’s where Take Profit orders come in handy. These let you automatically close out trades once they hit your desired profit level—no babysitting required.

→ Say you're long EUR/USD at 1.1000

→ You set Take Profit at 1.1050

→ When price reaches that level, boom—you’re out with a gain of 50 pips

This helps lock in profits during volatile sessions when markets move fast and unpredictably. Especially useful when you can’t monitor trades constantly on your mobile or desktop version of iq option forex.

How Leverage Influences Profit Calculation on IQ Option

When using leverage, small movements can mean big changes in profit—or loss. Here’s how different leverage ratios relate to pip-based outcomes using typical lot sizes:

| Lot Size | Pip Value | Leverage Used | Effective Trade Size | Impact per Pip |

|---|---|---|---|---|

| Standard Lot | $10 | x30 | $100,000 | $10 |

| Mini Lot | $1 | x50 | $10,000 | $1 |

| Micro Lot | $0.10 | x100 | $1,000 | $0.10 |

As shown above, even trading a tiny position with high leverage can result in significant swings—both up and down. Make sure you're not risking more than you’re ready to lose; risk management isn’t optional here.

The key takeaway? Know your numbers before clicking “Buy” or “Sell.” Whether you're just starting or scaling up on platforms like Fxbee or others offering access to iq option forex, understanding these mechanics keeps you one step ahead of market surprises.

Maximize Your IQ Option Forex Profits with Pip Strategies

Learn how to squeeze more from each pip using smart strategies on IQ Option Forex trades.

Employing Moving Averages to Identify Profit Opportunities

Simple Moving Average (SMA) helps smooth out price action, making trends easier to spot.

Exponential Moving Average (EMA) reacts faster to recent price changes—great for short-term traders.

Combine both SMA and EMA for clearer signals and better timing on entries and exits.

Using a 50-day EMA alongside a 200-day SMA often flags trend reversals. When the shorter average crosses above the longer one, it’s usually seen as a bullish sign. Many traders on iq option forex watch these crossovers like hawks. It’s not just about spotting direction—it’s about knowing when momentum is picking up steam.

Short bursts of volatility? That’s where EMAs shine. They adapt quickly, giving you an edge when markets move fast. Whether you're trading major currency pairs or dabbling in volatile ones like JPY crosses, moving averages offer clarity amid chaos.

The Role of Risk-Reward Ratio in Pip Trading Strategies

A good rule of thumb? Aim for at least a 1:2 risk-reward ratio.

This means risking 10 pips should aim to gain at least 20 pips.

Over time, this math works even if your win rate isn’t sky-high.

You could win only half your trades and still come out ahead if your winners are bigger than your losers. That’s why smart folks trading on iq option forex don’t just chase gains—they protect their downside too.

✦ Always set a tight but realistic stop loss, based on recent support/resistance—not gut feeling.

✦ Use pip calculators tied into your position size to keep risks consistent across trades.

The magic lies in discipline, not prediction accuracy. Even with small wins, compounding adds up fast when losses are capped tight.

How Chart Patterns Like Head and Shoulders Can Boost Profits

• The Head and Shoulders pattern signals an upcoming reversal—perfect for catching shifts early.

• Spotting it involves identifying three peaks: two shoulders with a taller “head” between them.

• Once the neckline breaks? That’s usually go-time for many seasoned traders on platforms like iq option forex.

There’s also the Inverse Head and Shoulders—a bullish version that hints at bottoms forming after downtrends crash hard. These setups aren’t just pretty pictures—they’re battle-tested formations backed by decades of trader psychology baked into charts.

When paired with other tools like technical indicators, these patterns become even more powerful confirmation signals before pulling the trigger on trades involving high-volatility pairs or larger lot sizes.

Want more accurate entries? Wait for volume spikes near breakout points—that's often where big money steps in, tipping off strong follow-through potential across multiple timeframes on IQ Option's chart interface.

References

What Are Pips in Forex Trading, and What Is Their Value? - https://www.investopedia.com/terms/p/pip.asp

What is a Pip in Forex? - https://www.babypips.com/learn/forex/pips-and-pipettes

Margin Trading — How Does It Work? (IQ Option Blog) - https://blog.iqoption.com/en/margin-trading-how-does-it-work/

Pip Calculator (Myfxbook) - https://www.myfxbook.com/forex-calculators/pip-calculator

Forex Pip Calculator: How to Calculate Pips in Forex (FXBee) - https://www.fxbee.com/article/how-to-calculate-pips-in-forex

What Are Lot Sizes in Forex? (FXBee) - https://www.fxbee.com/article/what-are-lot-sizes-in-forex

How to Calculate Leverage in Forex Trading (FXBee) - https://www.fxbee.com/article/how-to-calculate-leverage-in-forex-trading

FXBee – Forex Trading Affiliate Network - https://www.fxbee.com/

Forex Volatility: Understanding, Analyzing & Trading Currency Fluctuations (OANDA) - https://www.oanda.com/us-en/trade-tap-blog/asset-classes/forex/forex-volatility--understanding-analyzing-trading-currency-fluctuations/

FAQ

What is a Pip in IQ Option Forex Trading?

A pip marks the tiniest shift in a currency pair's price. In EUR/USD or GBP/JPY, it’s often the fourth decimal place (0.0001). Traders on MetaTrader 4 or WebTrader track every pip to measure gain or loss—each one can tilt fortune toward joy or regret.

How do I calculate pip value when trading EUR/USD?

1. Identify standard pip size: 0.0001 for EUR/USD.

2. Multiply by your lot size—micro, mini, or standard—to get dollar impact per move.

3. Platforms like cTrader instantly show this; yet seeing that math unfold yourself makes each trade feel alive and deliberate.

Why does market condition analysis matter for profits?

An uptrend stirs optimism; a downtrend warns of brewing storms in AUD/USD and USD/CHF charts on TradingView. Spotting consolidation helps avoid flat battles. Volatility moments demand quick Market Orders or Stop Loss Orders before tension breaks into losses.

Can technical indicators like Moving Average boost returns?

Moving Averages whisper where trends breathe steady; RSI shouts overbought warnings; MACD sketches momentum swings. Fibonacci Retracement draws anchors during pullbacks in NZD/USD so entries become poised rather than rushed.