Table of Contents

lot size. In this guide, we’ll break down what are lot sizes in forex and why this seemingly simple number could be the difference between blowing your account or building real momentum.

Think of lot sizes like buying gas: you wouldn’t fill up a race car and a lawn mower the same way. Trading works the same. “If you don’t size your trades right, your risk will eat you alive,” says John Russell, former currency analyst for FXCM. We'll show you how to match the lot size to your risk, account, and style.

No fluff. Just clear examples, bite-sized comparisons, and a roadmap to help you stop guessing and start trading smart. Let’s dive in.

What Are Lot Sizes in Forex

Forex trading operates on a standardized concept known as lot size, a term that directly determines the volume of each trade. Whether you are navigating the markets with a standard lot (100,000 units), scaling with a mini lot (10,000 units), experimenting with a micro lot (1,000 units), or fine-tuning precision with a nano lot (100 units), the size you choose fundamentally shapes your exposure, risk, and capital engagement.

“Choosing the right lot size is like adjusting your car’s gears before a mountain climb,” explained veteran trader Jack Monroe in a panel hosted by ForexLive. “Position sizing aligns directly with your leverage, your available margin, and even the smallest movement—your pip value—can impact your account.”

From institutional desks to first-time retail traders, the lot structure allows for accessibility across all account sizes. Large-scale traders often operate in standard lots, whereas beginners may cautiously begin with micro or nano lots as part of effective risk management.

Key trading terms interwoven with lot size:

Trading volume: Reflects your lot size multiplied by the number of open positions.

Margin: A small capital deposit required to open a leveraged position.

Leverage: Amplifies both potential profits and losses relative to your lot size.

Pip value: The value of each pip shift depends on your lot type.

Brokers such as IG and Forex.com have provided detailed breakdowns of lot types in their educational libraries, reinforcing the universal standard that shapes every trade decision. Whether using manual strategy or automated systems, understanding lot sizes is critical for every trader.

Regulatory bodies like the FCA (UK) and CFTC (US) require clear disclosure of position sizes, highlighting their essential role in transparency and capital protection.

Lot size is more than a number—it is a core mechanic of position sizing strategy and capital discipline. Seasoned professionals treat it as a decision just as important as selecting a currency pair.

Understanding Forex Lot Size Calculation

Mastering lot size calculation is the key to smart forex trading. This cluster breaks down how to size your trades without burning your capital.

Pip Value Based on Lot Size

Pip value changes depending on your lot size and the currency pair being traded. Here's a basic comparison using the EUR/USD:

| Lot Size | Pip Value (USD) | Units |

|---|---|---|

| Standard Lot | 10.00 | 100,000 |

| Mini Lot | 1.00 | 10,000 |

| Micro Lot | 0.10 | 1,000 |

Formula: Pip Value = (Pip in Decimal * Lot Size) / Exchange Rate This is critical for calculating profits or losses per pip movement!

Leverage and Its Lot Impact

Leverage amplifies both potential gains and losses by increasing your market exposure.

A $1,000 account with 100:1 leverage controls up to $100,000.

This allows trading a standard lot, but margin requirements rise.

Bigger lot size + higher leverage = higher risk.

Pro Tip: Don’t max out leverage just because it’s there. You’re not trying to blow up your account for fun.

???? “Leverage is a double-edged sword. Use it wisely or it’ll slice your capital.” — J. Brooks, veteran FX analyst

Risk Management Per Trade Formula

If you're not using a position sizing formula, you're basically gambling. Smart traders use this:

Define your risk percentage (e.g., 2% of account).

Set your stop-loss in pips.

Apply this formula:

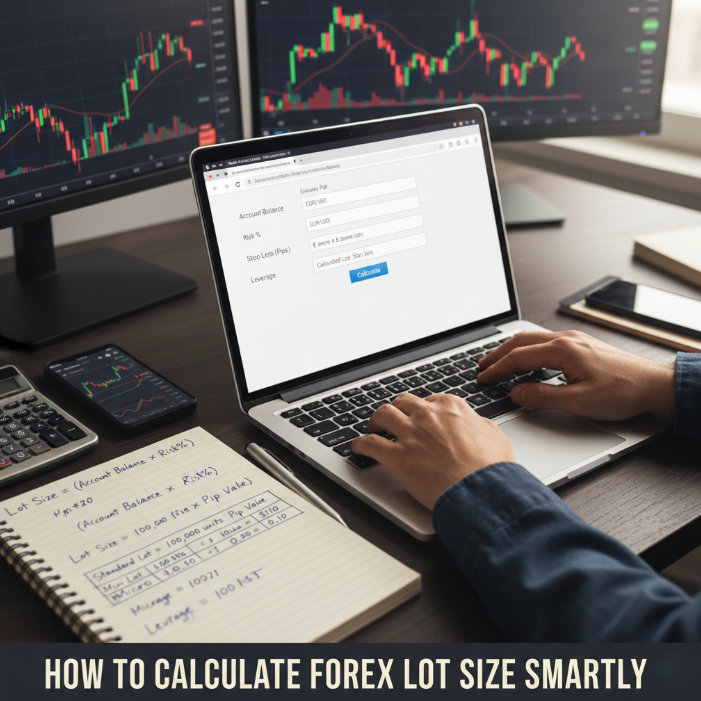

Lot Size = (Account Balance × Risk%) ÷ (Stop Loss in Pips × Pip Value)

This formula is your shield against capital loss. Stick with it.

Lot Size Calculators for Beginners

New to forex? Don’t stress — let a lot size calculator do the math. Most trading platforms offer built-in tools.

Choose your currency pair

Enter your account size and risk tolerance

Boom! It tells you your perfect position size

These calculators are a lifesaver for beginner traders who don't want to bust their first account.

Standard, Mini, Micro, and Nano Lots Explained

Explore the four types of forex lot sizes. This guide breaks down who they’re for, why they matter, and how they impact your trading game.

1. Who Uses Mini Lots and Why

Mini lots—equal to 10,000 units—are ideal for forex traders with moderate capital. Many beginners and smaller accounts use mini lots to reduce risk while still engaging meaningfully in the market.

Why they work:

Good balance of risk vs reward

Suitable for risk management

Perfect step-up from micro lots

“Mini lots are where most retail traders build their real confidence,” says Alex Tai, a senior strategist at FXEdge Research.

2. Benefits of Trading Micro Lots

Micro lots, at just 1,000 units, are a fan favorite for anyone dipping their toes into forex trading with small capital. Why? Because you're playing with real money but without real danger.

You can test strategies safely

They're perfect for tight risk management

Allows real-world trading with tiny drawdowns

This is where you try, learn, screw up (a little), and still sleep at night.

3. When to Use Nano Lot Sizes

Nano lots (100 units) are rarely offered—but when they are, they’re gold for extremely small accounts or high-leverage testing.

Great for testing EAs or bots without risking real capital

Used by beginners for platform familiarization

Helps develop psychological discipline in live markets

| Lot Type | Units | Common Users |

|---|---|---|

| Nano Lot | 100 | Beginners, testers |

| Micro Lot | 1,000 | Learners, cautious |

| Mini Lot | 10,000 | Traders, small funds |

Picking the right lot size in forex is like choosing the right gear on a bike—you want control, not chaos. Go too big too fast, and you're wiped out by the first market bump. Go too small, and you’re spinning your wheels with little to show.

Smart traders match their lot size to their wallet and mindset. As trading coach Kathy Lien once said, "Risk management isn't sexy, but it keeps you in the game."

Faq

A standard lot in forex trading represents 100,000 units of the base currency. It's the default size for professional and institutional traders. If you're trading EUR/USD, one standard lot would be €100,000.

Lot size directly controls how much each pip movement is worth. The bigger your lot size, the greater your gains—or losses—per pip.

This makes lot size a core factor in your risk management.

Standard lot: 1 pip ≈ $10

Mini lot: 1 pip ≈ $1

Micro lot: 1 pip ≈ $0.10

Nano lot: 1 pip ≈ $0.01

Yes, and many do! Nano lots (100 units) are perfect for testing strategies with real money but minimal risk. They're ideal for:

New traders learning with small accounts

Conservative traders who want to control exposure

Practicing under live-market conditions

Brokers who support cent or nano accounts

The smallest commonly available lot size is the nano lot, which equals 100 units of the base currency. Not all brokers offer it, but those who do typically label it as a “cent” or “nano” account.

Absolutely. A lot size calculator lets you enter your account balance, risk percentage, stop-loss, and currency pair to automatically determine:

Many brokers and platforms like Babypips or Myfxbook offer free tools.

The correct lot size

The pip value per lot

The total risk per trade

The difference is mostly in position size and risk exposure:

If you're unsure which to start with, micro lots offer more flexibility and smaller risk.

Mini lot: 10,000 units = $1 per pip

Micro lot: 1,000 units = $0.10 per pip

Yes, MT4 and MT5 platforms allow fractional lot sizes, such as 0.02, 0.13, or even 0.01, depending on what your broker supports. This lets you fine-tune your trade size to match your risk tolerance perfectly.

To trade 1.0 standard lot, you typically need at least $1,000 to $2,000 with 1:100 leverage—but:

More leverage = lower capital needed, but higher risk

Less leverage = more capital needed, safer risk profile

Always adjust lot size based on stop-loss and risk %

Absolutely. In scalping, where trades last seconds or minutes, precision is key:

A scalper’s best friend? A pre-planned lot size + stop-loss combo.

Too large a lot can wipe out gains with one bad move

Too small, and you won't cover spreads or commissions

Lot sizing needs to match both volatility and speed