Table of Contents

can save your butt when things get hectic, but only if you know how to use it right. How is Profit Calculated in For…

Think of it like driving with GPS. Sure, you could go old-school with a map, but why risk getting lost when a few clicks show you the fastest route to your goal?

Some traders stick with manual math out of habit. Others don’t trust tools they haven’t tested. But here’s the deal: both approaches work—if you understand the core mechanics.

“Too many people rely on instinct without learning the formula,” says Josh Lin, product engineer at Fxbee. “That’s where most losses come from.”

In this guide, we’ll walk through the basics, compare tools vs. old methods, spotlight what really affects your bottom line—and show you how to avoid rookie mistakes that even seasoned traders make.

What is Forex Profit and How Is It Calculated?

Ever wonder where that “profit” number actually comes from in forex trading? Let’s break it down in plain English.

To learn and practice, explore resources from FXBee.

How Profit Happens in Forex Trading

You’re trading currency pairs, like EUR/USD or GBP/JPY.

Your base currency is the one you're buying or selling (left side of the pair), and the quote currency is the one you’re using to measure the value (right side).

The profit shows up when the market moves in your favor after you enter a trade — simple, right?

2 Simple Scenarios: Buy vs. Sell

Let’s walk through how profit is calculated in both buying and selling.

1. Buying (Going Long)

You buy low, and then sell high.

Example: Buy EUR/USD at 1.1000 and close the trade at 1.1100.

Profit is made because the exit price is higher than the entry price.

2. Selling (Going Short)

You sell high, and then buy low.

Example: Sell GBP/USD at 1.3000, and exit at 1.2900.

Profit comes from the price dropping.

Now, this is all great on paper, but the real trick is in the math behind it.

The Core Formula (Without the Jargon)

To make sense of all the moving parts, here’s a look at the actual formula behind your profit:

| Position Size | (Exit Price - Entry Price) | Pip Value | Leverage Applied |

|---|---|---|---|

| 100,000 units (1 standard lot) | 1.1100 - 1.1000 = 0.0100 | $10/ | 50:1 |

| 10,000 units (1 mini lot) | 1.2900 - 1.3000 = -0.0100 | $1/ | 30:1 |

| 1,000 units (1 micro lot) | 1.2050 - 1.2000 = 0.0050 | $0.10/ | 20:1 |

???? Your value and play a huge role in what you earn (or lose).

Quote From the Field

“A lot of beginners ignore position size, and that’s where mistakes happen. Even with the right prediction, bad sizing means low profit or heavy losses.” — Jason Morales, Senior Risk Manager at Fxbee

Don’t Forget the “Fine Print” Costs

Sure, profit sounds easy when looking at price changes. But your real number is shaped by:

– The tiny gap between bid and ask price. It’s small, but it eats into your gains.

Commission – Especially with ECN brokers, these are fixed fees per trade.

– If you hold overnight, your broker might charge (or pay) based on interest rates.

Put simply: if you ignore these, you might think you're making money, when you're really not.

Key Takeaways

Profit = (Exit Price - Entry Price) × Position Size × Value.

Don’t eyeball it — .

Leverage helps you open bigger trades, but it also means higher risk.

Always check the and commission before you click “buy” or “sell.”

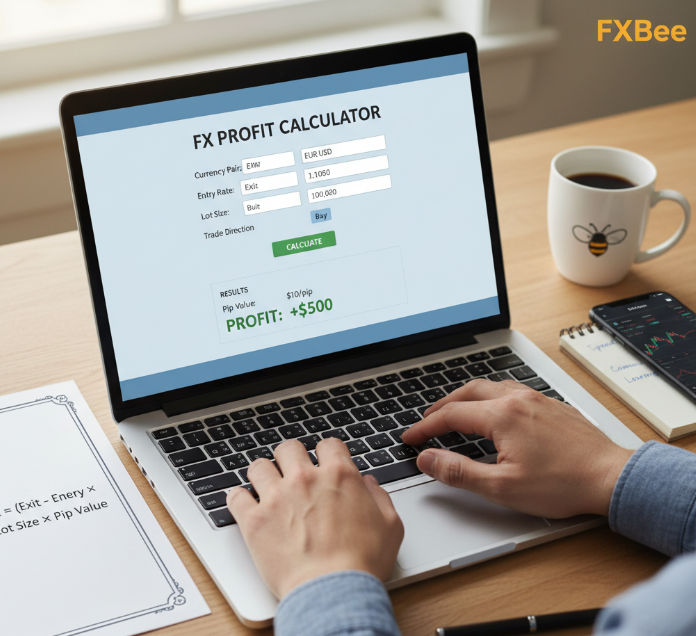

Forex Profit Calculator: A Tool You Shouldn’t Ignore

No need to pull out a spreadsheet every time. A does the math fast—and way more accurately.

Inputs You Must Enter: Lots & Units

You’ve got to punch in the right stuff or the tool’s useless.

Key inputs: lots, units, and your trade direction (buy/sell).

A standard lot is , but calculators also work with mini (10,000) and micro (1,000) lots.

Choose the wrong size? Your numbers could be off by hundreds of USD.

Always double-check that the input matches your actual position size in your app.

How Exchange Rates Affect Calculations

Exchange rates are the heartbeat of any forex profit calculator. A tiny shift in the entry rate or exit rate can flip a gain into a loss, especially if you’re trading something volatile like GBP/JPY.

Here’s a quick sample using live-ish numbers:

| Currency Pair | Entry Rate | Exit Rate | Market Movement |

|---|---|---|---|

| EUR/USD | 1.1000 | 1.1050 | +50 |

| USD/JPY | 145.00 | 144.20 | -80 |

| AUD/NZD | 1.0700 | 1.0730 | +30 |

Your profit or loss depends on the direction of the trade (long or short) and how much volume you’re working with. The calculator does the heavy lifting—just make sure those rates are accurate.

Auto-Calculating Profit, Loss, and Return

"When traders guess their return, they lose. Calculators don’t guess." — Sophie Tran, Senior Engineer at Fxbee

A shows profit, loss, and return based on your inputs in real time. Here’s how it typically works:

It subtracts entry rate from exit rate.

Multiplies the difference by your lot size.

Shows a return value instantly, adjusted for currency.

Whether you went long or short, this tool helps prevent gut-based trading decisions. Just hit "calculate" and you’ll get the net profit or loss instantly.

Commission, Spread & Fees in Auto Results

Hidden costs? Yeah, they sneak up.

Many calculators bake in extras like:

(the difference between the buy and sell price)

Commission charged per trade or per lot

if you hold the position after market hours

These little monsters nibble at your gross profit and leave you with less in hand. So if you're using a calculator, always check if it's showing net outcomes or just the clean math—some of them leave out these extra charges, and that can mess with your expectations.

Manual vs. Calculator: Which Is More Accurate?

Is punching numbers by hand better than letting the machine do it? This is where most traders get stuck — and sometimes, lose money.

Manual Precision

Manual calculation can help traders really understand how forex profit works.

You control value and lot size decisions down to the decimal.

With direct inputs for currency pair and exchange rate, you can adapt on the fly.

That said, manual precision needs time — and mistakes are way too easy.

"Doing it yourself feels solid, but just one pip off and you’ve thrown off your profit by a mile."

Tool-Based Accuracy

Want fast, accurate results? Use a **.

Plug in your position size, currency pair, and entry/exit rate.

The calculator runs instant profit calculation — zero guesswork.

Automated tools consider risk assessment, margin requirements, and more.

Results are consistent, especially when you’re juggling multiple trades.

Sample Forex Calculator Accuracy Table

| Currency Pair | Lot Size | Entry Rate | Calculated Profit |

|---|---|---|---|

| EUR/USD | 1 lot | 1.1050 | $950 |

| GBP/JPY | 0.1 lot | 163.200 | ¥12,800 |

| USD/CAD | 0.5 lot | 1.3450 | C$430 |

Hidden Costs Matter

Here’s the kicker — traders often miss sneaky charges that chip away at your profits.

: Even small differences between buy/sell rates eat into returns.

Commission & fees: These show up like uninvited guests in your trade report.

: Hold a position overnight? You might pay more than you think.

The truth? Transaction costs always impact your real profit margin. If you’re not factoring in those hidden costs, your overall profitability is just an illusion.

3 Core Factors That Impact Forex Profitability

These three big drivers decide whether you rake in profit or bleed cash in forex. Know them, and you're already ahead of the pack.

Currency Volatility: USD, EUR, JPY & More

Currency pairs like USD/JPY or EUR/USD swing fast—especially during major news drops.

High volatility means high risk, but also bigger profit opportunities if timed right.

Trading during low market fluctuations may feel safer, but gains are smaller.

→ Tip: Watch economic calendars—big USD announcements can yank the charts fast.

Position Size and Volume

Here’s how position size and volume mess with your returns—and risk:

| Lot Size Type | Units | Risk Level | Capital Required |

|---|---|---|---|

| Micro Lot | Low | Very Low | |

| Mini Lot | Medium | Moderate | |

| Standard Lot | High | Significant |

Bigger lot size = bigger profits (or losses).

Use leverage carefully—it can eat your margin like wildfire.

Smart traders match capital allocation to risk appetite.

Exchange Value Changes

The way the exchange rate jumps can either boost your gains or drain your account.

Sometimes a few of price movement is all it takes to make (or break) a trade—especially with high leverage. A currency's appreciation or depreciation depends on market trends, but also geopolitical surprises. One headline and boom—your EUR/USD long could turn ugly.

Reading the flow and knowing the "why" behind price shifts makes all the difference.

Trade Direction: Long or Short Impact

Short on JPY or long on EUR? Your trade direction shapes your outcomes:

Buy low, sell high is the dream.

A long position bets prices go up.

A short position banks on a drop.

Use trend analysis to guide your calls.

Pick wrong, and even perfect timing won't save you. It’s not just about movement—it’s about movement in your favor.

Extra Charges Reduce Your Net Profit

Fxbee’s senior analyst Mark Chen once said: “Most traders don't lose to price—they lose to hidden costs.”

Every takes a bite.

Commissions stack up faster than coffee orders.

and broker fees sneak in when trades stay open too long.

Ignoring transaction costs wrecks your net profit.

Tighten the leaks before chasing the waves—smart money watches both the trade and the fees.

Common Mistakes When Using a Forex Profit Calculator

Even seasoned traders slip up with profit calculators. These common blunders could be costing you real money.

Ignoring Ask vs. Bid Differences

When using a forex calculator, skipping over the ask price and bid price can totally skew your profit calculation. Those few pips matter — big time — especially in high-volatility currency pairs like GBP/JPY or EUR/USD.

✅ Quick Tips:

Always check the before entering trades.

Calculators use market rates, but you must adjust for direction (buy vs. sell).

Volatile pairs = larger spreads = higher risk of miscalculation.

| Currency Pair | Bid Price | Ask Price | Spread (Pips) |

|---|---|---|---|

| EUR/USD | 1.0832 | 1.0836 | 4 |

| GBP/JPY | 153.200 | 153.245 | 4.5 |

| USD/CHF | 0.9015 | 0.9020 | 5 |

Wrong Lot Size Selection

Picking the wrong lot size or not matching it to your account balance is like playing darts blindfolded. It wrecks your risk management and throws off your pip value math.

Don’t trade a standard lot with a $500 account. That’s just wild.

Match your position size to your leverage and margin.

are tools—use them wisely.

A mismatch can burn your entire balance on one trade.

Forgetting Fees Reduce Gains

Fees sneak in like quiet thieves. Many calculators ignore things like and commission, but you shouldn’t.

Transaction costs eat into your net profit — every time.

Brokerage fees might not seem big but add up fast.

for overnight trades are often overlooked and underestimated.

Ignoring fees gives you a false profit margin.

Messing up profit calculations can be subtle — like forgetting that ask price isn't what you sell at, or thinking you're winning big while hidden costs drain your profit margin. Keep your lot size smart and your eyes on the fees.

Conclusion

Making sense of profit in forex trading isn’t just about crunching numbers—it’s about seeing the full picture. From your trade size to what the market's whispering at entry and exit, every detail counts. And let’s be real: nobody wants to spend hours on spreadsheets. That’s where a steps in—like a GPS for your trading decisions.

Quick hits to keep you on point: • Don’t sleep on the —it eats into your wins. • Use the right ; don’t go big unless your wallet can take a hit. • Always factor in those . • Run the numbers before the trade, not after.

As Warren Buffett once said, “Risk comes from not knowing what you’re doing.” You're not just reading—you're learning how to think like a trader who plays the long game. Profit isn’t luck. It’s preparation. Keep sharpening your edge. And if you need tools, tutorials, and partner perks to grow your trading brand, explore and the by FXBee.

References

Calculating Profits and Losses of Your Currency Trades — Investopedia —

What Are Pips in Forex Trading, and What Is Their Value? — Investopedia —

Pips and How They Work in Currency Pairs — Investopedia — https://www.investopedia.com/ask/answers/06/pipandcurrencypair.asp

Differences Between Pips, Points, and Ticks — Investopedia — https://www.investopedia.com/ask/answers/032615/what-difference-between-pips-points-and-ticks.asp

Bid-Ask Spread: Definition — Investopedia —

Ask: What it is, How it Works — Investopedia — https://www.investopedia.com/terms/a/ask.asp

How to Calculate the Bid-Ask Spread — Investopedia — https://www.investopedia.com/articles/investing/082213/how-calculate-bidask-spread.asp

What is a Lot in Forex? — BabyPips —

Lot — Forexpedia (BabyPips) —

How Our Financing Fees Are Calculated (Swaps/Rollover) — OANDA —

FX Trading Pricing (Holding/Overnight) — OANDA —

FAQ

You figure it out by taking the difference between your entry and exit rate, then multiplying that by the size of your trade. Fees like spread or commission can eat into that profit.

Avoids math mistakes

Calculates based on actual rates like USD/JPY or EUR/USD

Factors in trading costs like spread and swap

Works fast so you don’t waste time guessing

Yes, it matters. You buy at the ask price and sell at the bid. If the gap is big, it can eat into your gains, especially in fast-moving markets.

Currency pair (like GBP/USD)

Trade size (mini lots, 1000 or 100000 units)

Entry and exit rates

Costs like spread and fees

It makes small changes in price feel big. That means you can win more — or lose more — depending on how the trade moves. It works fast in both directions.

Spread lowers your return right away

Commissions add up fast

Swap and rollover fees chip away over time

These costs hurt short-term trades most

Some pick the wrong trade size or forget to add fees. Others assume the price will stay steady. Even a small difference in rate or spread can throw off the numbers.

Micro lots (1,000 units) are good for learning

Mini lots (10,000 units) offer balance

Standard lots (100,000 units) need more confidence

Yes. It shows what you'll gain or lose when buying or selling. It’s useful for planning both kinds of trades, even with pairs like GBP/JPY or AUD/USD.

Some do, some don’t

Check if your platform adds them in

These fees can lower your profit overnight

Always read the fine print