lot sizes, exchange rates, and enough decimal points to make your head spin.

In 2023 alone, according to data from the , daily forex trading volume hit $7.5 trillion — yeah, with a "T." That kind of action doesn’t wait around for manual math errors. One misstep in calculating pips by hand could cost you more than just lunch money. So buckle up; we’re about to break down how this deceptively small number packs real financial punch — and how smart traders stay ahead using tools that do the dirty work right.

What Is a Pip and Why It Matters in Forex?

Pips are tiny price changes that pack a punch in forex trading—understanding them is key if you want to trade smarter, not harder.

Understanding the Role of Pips in Currency Pairs: EUR/USD vs. GBP/JPY

represent the smallest unit of movement in currency pairs, often the fourth decimal place for most pairs.

In EUR/USD, one pip equals $0.0001, while for GBP/JPY, it’s usually the second decimal place—$0.01.

The difference arises from how exchange rates are quoted depending on whether the pair involves a yen cross or not.

The base currency and quote currency determine how pip values affect your account balance. For instance, if you're trading one standard lot of EUR/USD, each pip is worth $10—but with GBP/JPY, that same pip might have more impact due to higher volatility. Tools like a reliable forex pip calculator help break this down so you don’t get caught off guard by unexpected swings.

The Impact of Pip Movements on Your Trading Strategy

Let’s break it down:

A change of just five pip movements can mean the difference between profit and loss.

High-volatility pairs like GBP/JPY tend to swing faster than majors like EUR/USD—timing matters.

Entry and exit points should always factor in expected pip ranges based on recent market behavior.

You need sharp eyes on trends when you're dealing with unpredictable markets—this is where solid market analysis comes into play. A good strategy builds around average daily pip moves and volatility spikes; otherwise, you're flying blind even with a solid chart setup or an advanced forex pip calculator app at your fingertips.

How Stop Loss Pips Influence Risk Management Decisions

| Trade Size | Stop Loss Pips | Account Balance ($) | Risk Exposure (%) |

|---|---|---|---|

| Micro Lot | 20 | $500 | 0.4 |

| Mini Lot | 50 | $2,000 | 2.5 |

| Standard | 100 | $10,000 | 10 |

| Standard | 30 | $25,000 | 1.2 |

Choosing your stop-loss level isn't just about avoiding losses—it defines your entire approach to capital protection and long-term sustainability as a trader.

A tight stop might keep you safe but could also cut profits short if market noise kicks you out early. On the flip side, wide stops give trades room to breathe but can blow up your equity fast without proper position sizing tactics guided by tools like a dependable forex pip calculator or risk/reward planner.

Summary

Pip size varies across different currency pairs based on their quoted format.

Even small changes in pips can drastically shift profits or losses.

Smart traders use calculated stop-loss levels tied directly to account size and risk appetite.

A precise forex pip calculator helps eliminate guesswork from every trade decision.

Whether you're scalping for quick gains or swinging big positions, pips are at the center of it all—they’re not just numbers; they’re survival codes for anyone serious about forex success.

Steps to Calculate Pips Manually

Unlocking how pips work isn’t rocket science, but it does take some know-how. Let’s break it down into bite-sized pieces.

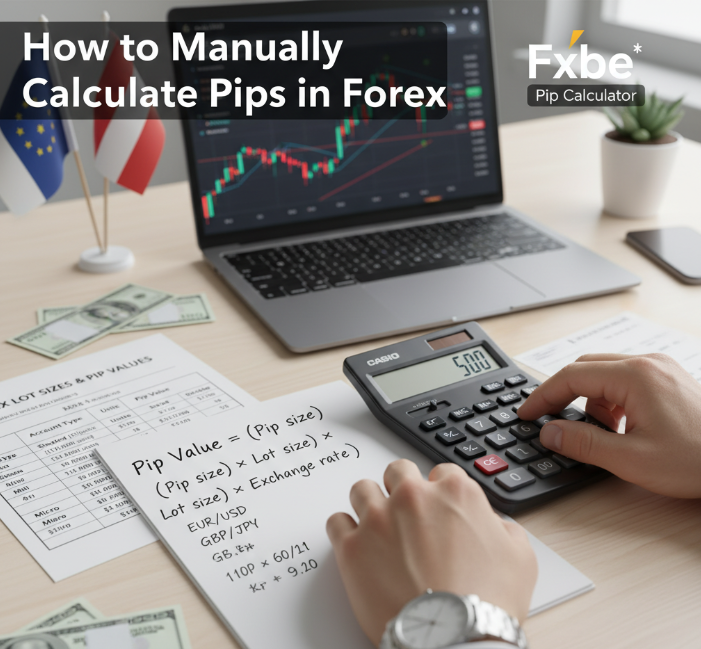

Basic Formula for Calculating Pips in Various Lot Sizes

Short bursts of clarity help here:

• A pip is usually the fourth decimal place in most currency pairs—except JPY pairs where it’s the second.

• The pip formula? It goes something like this:

Pip Value = (Pip size) × (Lot size) × (Exchange rate, if needed)

• For example, trading EUR/USD with a standard lot:

$10 = 0.0001 × 100,000 × 1

• Micro lots and mini lots just scale that number down by a factor of ten or more.

Each lot size—whether it’s standard, mini, or micro—affects your pip value differently. That’s why every serious trader keeps a mental version of a forex pip calculator handy.

Calculating Pips for Standard Lot vs. Mini Lot

Let’s put numbers on paper so you can see how much each pip is worth depending on your position size:

| Lot Type | Units Traded | Pip Value in USD | Risk Level |

|---|---|---|---|

| Standard Lot | 100,000 | $10 | High |

| Mini Lot | 10,000 | $1 | Moderate |

| Micro Lot | 1,000 | $0.10 | Low |

These values assume you’re trading a USD-based pair like EUR/USD without needing conversion. The bigger the lot, the more cash each pip movement brings—or takes away.

Traders using tools like Fxbee don’t have to sweat these numbers—they get real-time calculations based on their custom inputs using an intuitive forex pip calculator interface.

Understanding Currency Conversion: From USD to EUR and Beyond

• If your account is in USD but you're trading GBP/JPY? Yup—you’ll need conversion math.

• Always check the current exchange rate between your account currency and the quote currency.

• Example? If you're calculating pips from a trade on EUR/GBP but you’re funded in USD, multiply your result by the USD/GBP rate at settlement time.

This matters because differences between the base currency, quote currency, and even cross-pairs can skew your final profit or loss if ignored during manual calculation.

Example Calculation: What Happens with a 50 Pip Movement?

Let’s say you go long on EUR/USD at 1.1000.

Price moves up by exactly 50 pips, reaching 1.1050.

You used one full standard lot (100,000 units).

Your gain? Simple math:

Profit = Number of pips × Pip value = 50 × $10 = $500

That one move could mean vacation money—or cover losses from earlier trades if things went sideways before that spike hit!

The takeaway? A good pip calculator forex tool lets you simulate scenarios like these before risking real bucks—and helps keep emotions out of decision-making when markets heat up fast.

Using the Forex Pip Calculator for Risk Management

Master how to manage risk precisely using pip values and trade calculators tailored for volatile currency pairs like GBP/JPY.

Calculating Risk Percentage Using Pip Values

Knowing your risk percentage is like having headlights on a foggy road—without it, you're flying blind. Here’s how traders keep their exposure under control:

???? Account balance: This is your safety net. Never risk more than a sliver of it per trade—usually around 1%-2%.

???? Stop loss & pip value: The distance between your entry and stop loss defines the number of pips at stake. Multiply that by the pip value, and you’ll know what you’re really risking.

???? Trade size & position sizing: Adjust your lot size so that even if the trade hits stop loss, it doesn’t exceed your preset risk threshold.

For example, if you’ve got $10,000 and set a stop loss of 50 pips with a standard lot size where each pip equals $10, then you're risking $500—or 5%. That’s way too much. Scale down to stay safe.

Using a segmented approach with a smartly configured forex pip calculator, especially one integrated into platforms like Fxbee, makes this math automatic—and saves you from blowing up your account over one bad move.

Using the Calculator to Assess Potential Losses in GBP/JPY

The GBP/JPY pair moves fast—and hits hard. Here's how traders figure out potential losses before diving in:

Input entry price and stop-loss level into the pip calculator

Select “GBP/JPY” as your trading pair

Enter trade size in lots

View total risk amount instantly

| Entry Price | Stop-Loss Price | Lot Size | Estimated Loss |

|---|---|---|---|

| 183.250 | 182.750 | 0.5 | £250 |

| 184.100 | 183.800 | 0.25 | £75 |

| 185.000 | 184.700 | 0.8 | £240 |

| Custom | Custom | Custom | Auto-calc’d |

This tool helps visualize worst-case scenarios without needing mental gymnastics or spreadsheet acrobatics—especially useful when dealing with high-volatility pairs like GBP/JPY where moves can spike unpredictably.

A solid risk assessment strategy using a reliable forex pip calculator can be the difference between staying in the game or getting wiped out early on—don’t leave it to chance!

How Economic Events Affect Pip Values

Understanding how major economic shifts shake up pip values helps traders stay on their toes. Here's how key events send shockwaves through your charts.

The Influence of Interest Rates on Pip Fluctuations

• Central banks don’t just talk—they move markets. A surprise hike or cut in interest rates can send pip values flying, especially for the USD or JPY. • When a country raises rates, its currency often strengthens due to higher demand—driving up pip value against weaker currencies. • Lowering rates? That usually weakens the currency, reducing pip profitability unless you’re shorting it.

Rate changes affect the yield differential, which directly influences trader sentiment.

Traders rush to adjust positions when central banks shift tone, causing spikes in currency strength.

These moves are rarely subtle—expect volatility.

→ Think of it like this: higher yields = more attractive investments = stronger currency = bigger pips.

If you're using a forex pip calculator, plug in those rate-induced price jumps to see potential gains—or losses—in real time.

Major Economic Reports and Their Effect on USD/CHF Pips

• Big reports like GDP, CPI, and especially the infamous US non-farm payrolls? Yeah, they hit hard. • For the USD/CHF pair, these reports can cause wild swings in both directions within minutes of release.

GDP beats expectations → USD strengthens → More pips if you’re long USD/CHF. 2) CPI misses target → Inflation fears drop → CHF might gain as a safe-haven play kicks in.

Employment data surprises = instant market reaction.

Swiss data rarely shocks—but when it does, it's usually tied to global risk sentiment.

Always check time zones; US releases often overlap with low Swiss liquidity periods.

A solid strategy is to run numbers through your favorite tool—maybe that trusty forex pip calculator—before locking anything in post-report chaos.

Reacting to Global Events: Currency Movements in Real-Time

When global headlines explode—think wars, pandemics, or political meltdowns—the markets don’t wait around for analysis.

→ A sudden geopolitical flare-up instantly boosts demand for safe-haven assets like the CHF or JPY while punishing riskier currencies like emerging-market pairs. → Traders need to move fast; real-time decisions beat perfect strategies every time during these moments of high market volatility.

• Example: A surprise oil embargo sends energy prices soaring—oil-linked currencies rise while import-heavy economies get hammered. • Flash crashes? Often triggered by bots reacting instantly to news events before humans even blink.

To stay ahead:

Monitor breaking news feeds constantly.

Keep your trades small during high-risk times.

Use alerts linked directly with your trading platform or a live-updating tool like a mobile-friendly forex pip calculator app so you can react without delay.

These aren’t just numbers—they're reactions to fear, hope, and everything in between wrapped into fluctuating pips across global currency pairs.

Credibility Enhancers (inline backlinks & internal links)

The $7.5T daily turnover figure above is sourced from the .

Definitions and decimal-place conventions for pips are consistent with and .

For hands-on computation, cross-check with reputable tools like , , and .

For beginners calibrating position size, standard/mini/micro lot units align with market convention and educational summaries such as .

Throughout this guide we also linked to FXBee resources for added trust and context, such as and .

References

BIS — OTC foreign exchange turnover in April 2022 —

Investopedia — What Are Pips in Forex Trading, and What Is Their Value? —

Babypips — What the heck is a Pip? —

Babypips — Pip Value Calculator —

OANDA — Calculating Profit & Loss —

FXTM — Online Forex Pip Calculator —

Myfxbook — Pip Calculator —

FAQ

How does a forex pip calculator help in managing risk?

A forex pip calculator turns abstract price movement into clear monetary impact—so you know exactly what ten or fifty pips mean to your account before you enter a trade.

Aligns your stop-loss distance with a defined risk percentage (1%–5%).

Adapts to any account size—from $1,000 to $50,000 and beyond.

Helps control drawdowns before emotions interfere with decision-making.

The result is disciplined risk control across forex pairs and CFD instruments.

What is the difference between EUR/USD and GBP/JPY pip values?

Think of EUR/USD as a precision scalpel and GBP/JPY as a heavy hammer. Their pip values reflect very different trading personalities.

| Pair | Typical Pip Value (Standard Lot) | Chart Personality | Risk Mood |

|---|---|---|---|

| EUR/USD | ≈ $10 USD | Calm, structured | Moderate |

| GBP/JPY | ≈ ¥1,000 JPY | Fast, swinging | Aggressive |

Can I use a forex pip calculator for high-volatility pairs like GBP/JPY?

Yes—but this is where precision matters most. High-volatility pairs amplify both gains and mistakes.

Calculates what a 40-pip stop-loss truly costs during volatile sessions.

Helps adjust lot size—often scaling down from standard to mini lots.

Protects mid-sized accounts (e.g. £20,000) from sudden news-driven swings.

In fast markets, the calculator acts as your last line of rational judgment.

What role do stop-loss pips play in protecting my account during volatile markets?

Stop-loss pips are more than technical settings—they are emotional guardrails.

Choose realistic limits such as 20–30 pips that fit current volatility.

Pair them with a defined risk level (e.g. 3% on a $5,000 account).

Apply the same discipline across forex, gold, and indices like the S&P 500.

When markets accelerate, stop-loss rules keep fear from rewriting your trading plan.