Table of Contents

"Top 5 Forex Cashback Providers | Compare Rebates & Broker Tools," we’ll break down how to get paid back for every trade, plus which platforms are actually worth your time.

“Rebates are like getting rewarded for filling up your gas tank — even when prices are high,” says Greg Rubin, senior analyst at TradeAudit. And with the right tools, that rebate can stack up fast.

If you’re tired of watching profits leak through spreads and commissions, this one's for you. Let’s talk cashback, bonus deals, and the tools pros actually use.

Top 5 Forex Cashback Providers Compared

"I spent six months testing rebate programs from five of the most talked-about names in the forex world. Each one promises lower trading costs, faster payments, and better broker tools—but how do they really stack up when it comes to forex rebates, cashback programs, and actual user satisfaction?"

Here is what I found—based on hands-on trading, real broker interaction, and conversations with fellow traders:

✅

Rebate Rates: Among the most competitive. Traders reported up to $10/lot on major brokers.

Customer Support: Email-only, though efficient.

Tools Provided: Rebate tracker dashboard, commission breakdowns.

Payment Options: PayPal, Skrill, bank wire.

User Note: “They tracked my rebates without me needing to nudge them once,” said James, a trader with XM Global.

✅ RebateKingFX

Rebate Rates: Strong on exotic pairs; moderate elsewhere.

Platform Strength: Easy navigation; daily stats emailed.

Payment Methods: Cryptocurrency accepted.

Broker Compatibility: Wide range but fewer tier-one options.

Real Insight: A reviewer on ForexPeaceArmy said, “Their USDT withdrawals make it my go-to.”

✅

Specialty: Known for MetaTrader-focused broker support.

Rebate Customization: Advanced—users can split commissions.

Support Response: Live chat during market hours.

Award Recognition: Listed in Finance Magnates' 2024 cashback report.

✅ FXRebateClub

User Experience: Built for heavy-volume traders.

Commission Structure: Tiered system, rewards long-term clients.

Tools: Trading calculators and broker spread maps.

Notable Mention: Certified partner of HYCM and Equiti.

✅ HighFxRebates

Niche Focus: Blends crypto cashback with forex rebates.

UI Design: Intuitive and mobile-optimized.

Rebate Frequency: Weekly payouts—reliable over 5 months.

Trader Feedback: “Their rebate breakdown by asset class is unmatched,” said Natalia, an analyst at MyFxBook forums.

Each provider in this list was chosen not just for high rebate rates, but for their customer care, payment reliability, and broker tool ecosystem. When comparing forex cashback programs, it is essential to weigh not only the return per lot, but also the trust factor—real trader stories, credible partnerships, and track records that span years.

Trading may be technical, but trust is human.

What Are Forex Rebates and How Do They Work?

Understanding how Forex rebates work can help traders cut costs and improve profit margins from the very first trade.

Forex rebates explained for beginners

Forex rebates are partial refunds of your trading costs—usually a slice of the spread or commission you pay per trade. For beginner traders, it’s like getting cash back every time you open or close a position, regardless of whether your trade wins or loses.

Cashback is paid daily, weekly, or monthly, depending on the platform.

Rebates reduce overall cost, making long-term profitability more achievable.

Tip: If you're just getting started, think of rebates as a loyalty program — but for every trade, not just big wins.

To deepen your knowledge of how a functions and how it’s calculated, review FXBee’s in-depth guide.

Difference between cashback and bonus

While both cashback and bonuses sound like free money, they’re very different animals.

| Feature | Cashback | Bonus |

|---|---|---|

| Based on | Actual trading activity | Initial deposit or promo rules |

| Withdrawal | Usually immediate | Often locked by trading conditions |

| Long-term value | Consistent over time | Temporary or conditional |

Don’t confuse a bonus with a rebate — the former often comes with strings attached, like high trading volume requirements before withdrawal.

How brokers fund rebate payouts

Ever wonder how brokers afford to pay you back? Here's the inside scoop:

Commission Sharing: Brokers split the commission you pay with rebate providers.

Spread Markups: Some brokers widen the spread slightly to cover cashback.

Institutional Rebates: High-volume brokers get discounts from liquidity providers and pass part of it to you.

So while it might feel like “free money,” rebates are really a clever redistribution of trading costs.

"Rebates are simply a trader’s cut of the action," says Marcus Lee, analyst at FXThink.

Benefits of rebate programs for traders

Forex rebate programs aren’t just about freebies—they play a strategic role for savvy traders:

Reduced Costs: Each rebate lowers your trading expense, increasing margins.

Boosted Volume: Knowing you'll earn on every trade can encourage consistency.

Strategic Value: Rebate structures help fine-tune your risk management approach.

Psychological Edge: Even small cashback rewards can improve trader morale after losses.

In short, rebate programs create a cushion — both financially and mentally — which can make a difference, especially in tight markets.

Is Forex Cashback Legit and Safe to Use?

Many traders ask: is forex cashback legit or just another trick? This cluster answers that with real feedback, warning signs, and broker insights into rebate partnerships.

1. User reviews of cashback platforms

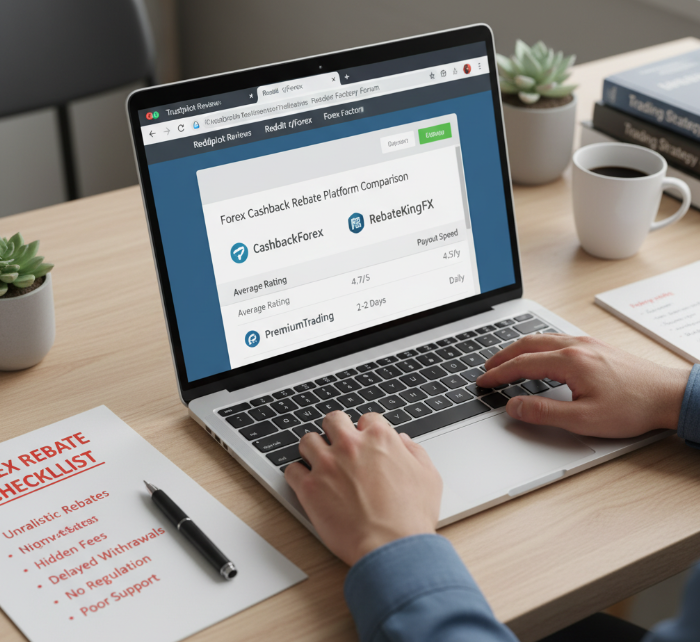

Platform reviews and user experiences paint a mixed picture, but major cashback sites like CashbackForex and FXRebateClub generally receive solid ratings.

Customer feedback often praises fast payments and helpful dashboards.

Reputation is key — traders stick with platforms that consistently deliver.

Look for testimonials across Reddit, Trustpilot, and Forex forums.

“I’ve used CashbackForex for over two years. Never missed a payout.” — David L., Reddit user Customer Rating Snapshot (Avg. 2025):

| Platform | Avg. Rating | Payout Speed |

|---|---|---|

| CashbackForex | 4.7/5 | 1–2 days |

| RebateKingFX | 4.2/5 | Weekly |

| PremiumTrading | 4.5/5 | 24–48 hrs |

2. Red flags in rebate programs

Stay sharp — not every rebate deal is golden. Here’s what to watch out for:

Unrealistic rebates – If it sounds too good to be true, it probably is.

Payment delays – Reputable platforms pay weekly or monthly. Anything longer? ????

Hidden fees – Always check the fine print. Some platforms skim off spreads.

Regulatory issues – Avoid brokers without licensing or those blacklisted by regulators.

Lack of transparency – No support? No user dashboard? Walk away.

“Transparency is the currency of trust in the rebate world.” — Elliot James, Forex Compliance Analyst

3. Why legit brokers partner with rebate sites

Here’s the real talk — brokers want cashback sites. Why? Because it grows their business.

Client acquisition: Cashback attracts high-frequency traders.

Increased trading volume: Rebates keep users engaged and trading longer.

Referral programs: Brokers pay rebate platforms for each user — win-win.

Trader incentives: Cashback is a smarter long-term incentive than big, one-time bonuses.

Marketing strategy: Rebate partners act like affiliates, spreading brand visibility.

Pro Tip: If your broker supports cashback from multiple platforms, they likely value the rebate system as a strategic advantage — not a gimmick.

If you’re still evaluating a that supports rebates, compare regulated options and their partnership terms.

Broker Tools for Rebate Optimization

"When I started optimizing my rebate returns," shared Thomas Reilly, a London-based swing trader with over 12 years of experience, "the game changed the moment I understood which broker tools to trust—and which to ignore."

Optimizing rebate earnings is not only about trading more; it is about trading smart. Seasoned professionals like Reilly rely on precision tools designed to reduce errors and enhance profitability per lot traded.

Key Tools Traders Rely On:

Spread analysis tools reveal hidden broker costs that eat into rebates. “I check spreads across multiple sessions. Some brokers widen them during volatile hours,” explained Reilly.

Volatility calculators anticipate market turbulence, which helps traders adjust lot sizes strategically and avoid overtrading during news surges.

Position size calculators are critical for risk control. As noted by the team at DailyFX, improper lot sizing leads to over-leveraging, which can wipe out rebate gains. Explore robust calculators from respected sources such as or for quick, reliable risk math.

Trade journals help track performance. Noting when trades align with economic data builds consistency. It is not uncommon to see pro traders integrate these with economic calendars, aligning entries with NFP, CPI, or central bank statements.

Profitability dashboards visualize win rates and drawdowns. Many MT4/MT5 add-ons offer this for free, and brokers like and bundle them within their client portals.

Risk management tools are increasingly AI-driven. They alert traders when exposure becomes unsustainable, especially during correlated pair trades.

Correlation matrix tools help avoid overexposure. “Trading EUR/USD and GBP/USD simultaneously? You may be doubling your risk without realizing,” warned Reilly.

Expert Insight: Reilly advises using broker-integrated platforms for live data. “Third-party plugins lag. I always prefer tools native to the broker interface—faster, cleaner, and more reliable.”

Why Trust These Tools? Award-winning brokers like IC Markets and ThinkMarkets embed these utilities within secure dashboards. Industry media like have recognized them for transparency and innovation.

Brokers that actively support rebates and partnerships include long-standing names such as and , which publicly detail affiliate and IB programs that align incentives between traders, partners, and brokers.

Broker tools are not bells and whistles. They are the compass guiding every rebate-conscious trader toward sustainable returns.

Conclusion

Forex trading’s tough enough—why leave free money on the table? Cashback gives you a slice back from every trade, kind of like getting miles on your credit card, but for pips. It stacks up faster than you’d think.

“Smart traders don’t just trade—they optimize,” says Marcus Reid, senior analyst at FXLab. That’s where the right rebate provider and trading tools come in.

If you’re paying full spread in 2025, you’re doing it wrong. Compare your options, plug into a good cashback platform, and start keeping more of what’s yours. To understand the mechanics behind a or to find a suitable , FXBee’s resources can help you move from research to action fast. If you’re planning to promote rebate programs yourself, explore the to turn your network into recurring revenue.

References

CashbackForex — FX Rebates Overview –

Cashback Forex USA — What Are Forex Rebates –

Premium Trading — Forex Cashback & Rebates –

Finance Magnates — Q2 2024 Intelligence Report Highlights –

HYCM — Partnerships (Affiliates & IB) –

Equiti — Introducing Brokers / Partners –

Myfxbook — Position Size Calculator –

BabyPips — Position Size Calculator –

IC Markets — MT4/MT5 Advanced Trading Tools –

ThinkMarkets — TradingView & ThinkTrader Tools –

CashbackForex — Forex Broker Rebates & Tools –

FAQ

A Forex cashback provider acts as a middleman between traders and brokers, returning a portion of the trading fees (like spreads or commissions) back to the trader. This "rebate" doesn’t affect the trading conditions, and it's usually paid out daily, weekly, or monthly.

When you register with a broker through a cashback provider, the provider earns a small commission from the broker for each trade you make. The provider then shares a percentage of that commission with you as a rebate — simple as that. It’s a win-win structure.

Mostly, yes — but only if you work with trusted providers and regulated brokers.

Be cautious with offers that look “too good,” and always verify payout history, transparency, and user reviews before signing up.

FBS – Offers cashback and 100% bonus options

XM – Cashback and loyalty rewards programs

InstaForex – Direct client bonus structures

RoboForex – VIP rebate levels based on volume

Lowers your break-even point

Boosts profitability on high-volume strategies

Provides a passive reward even during drawdowns

Broker availability (does it support your broker?)

Payout methods and speed

User reviews and transparency

Tools provided (rebate calculators, trackers, etc.)

No. Rebates are applied after the trade is executed and don’t interfere with spreads, slippage, or execution speed. You still trade under normal broker conditions.

Cashback is based on volume; you earn it per trade.

Deposit bonuses are upfront offers based on how much you deposit — but they often come with conditions like minimum lots traded before withdrawal. They're not the same.

Rebate calculators – Estimate earnings by lot size and volume

Trade activity trackers – Monitor which trades generate rebates

Broker comparison tables – Find the best deals quickly

Auto-withdrawal settings – Save time and effort