A quick scroll through social media and you're flooded with flashy apps, jaw-dropping returns, and influencers claiming they "cracked the code" — but most folks pause and wonder: Wait… is this even legal where I live?

Truth is, the answer isn’t a clean yes or no. Kind of like driving — it’s legal if you’ve got a license and follow the signs. But go off-road with the wrong broker or trade in banned pairs? That’s where things can get messy.

And it’s not just about rules on paper. Many traders get burned — accounts frozen, money stuck, tax trouble. "We’ve seen users lose years of savings to unregulated apps," says a senior engineer at Fxbee. “Just because it looks legit, doesn’t mean it’s RBI-approved.”

This guide is your cheat sheet. We’ll unpack the real deal — who makes the rules, which platforms are clean, and how to stay on the safe side without giving up the chance to trade.

If you’ve ever felt uneasy clicking “deposit” — this one’s for you.

Is Forex Trading Legal in India Today?

Can you legally trade forex in India? Let's break it down — no jargon, just the truth.

Wait, so is forex trading even legal here?

Yes… and no. Here's the catch: some forex trading is legal, and some can get you in trouble. It all depends on how you trade, who you trade with, and what currency pairs you mess with.

Let’s clear the fog with some straight facts:

1. Only Authorized Brokers Are Allowed

You can legally trade forex in India only through SEBI-regulated brokers — the ones recognized by RBI and operating under the Foreign Exchange Management Act (FEMA). These brokers typically operate on recognized Indian exchanges like:

They offer forex as exchange-traded derivatives, not on shady mobile apps offering 500:1 leverage.

????️ Quote from Fxbee Compliance Head, S. Mehta:

“Most retail traders we audit don’t even realize their broker isn’t licensed in India. That’s when the problems start—especially during withdrawals.”

2. INR Must Be Involved in Every Pair

Here’s the rule that keeps you on the right side of the line: trade only the currency derivatives that are listed on recognized Indian exchanges (and offered by SEBI-registered brokers). In practice, that means:

So yes to the classic INR pairs:

USD/INR

EUR/INR

GBP/INR

JPY/INR

And yes (on Indian exchanges) to a limited set of cross-currency contracts that are exchange-traded and ultimately settled in INR, such as:

EUR/USD

GBP/USD

USD/JPY

But no to the “anything goes” global menu you’ll see on many offshore apps, like:

AUD/USD

NZD/USD

GBP/JPY

XAU/USD

That’s the real issue — trading popular pairs through offshore platforms (especially with high leverage) is a regulatory red flag under FEMA, even if the same pair exists as an exchange-traded contract in India.

3. Offshore Platforms = Big No (Legally Speaking)

Ever used an app or website that lets you trade EUR/USD with insane leverage and zero INR involvement? That likely means you’re using an unauthorized offshore trading platform — and that's a legal gray zone with potential FEMA violations.

Penalties?

Yeah, we’re talking frozen accounts, foreign exchange violations, and RBI scrutiny. It’s not just theory. Real cases exist where Indian banks flagged remittances and blocked accounts linked to suspicious trading activities.

4. What FEMA and SEBI Actually Want

Let’s simplify what these two big players are all about:

| Authority | Focus | Forex Role | What They Allow |

|---|---|---|---|

| RBI | Capital flow, currency stability | Controls cross-border transactions | Only INR-paired trading via recognized exchanges |

| SEBI | Investor protection | Regulates brokers, platforms, and markets | Permits forex derivatives under strict rules |

| FEMA | Legal framework | Covers all forex activity by Indian residents | Prohibits unauthorized forex trading abroad |

So, if you’re an Indian resident trading on a flashy app you saw on Instagram, and that app isn’t RBI or SEBI approved — you're probably outside the legal comfort zone.

5. What You Can Do (Without Breaking Rules)

Trade INR-based currency pairs on NSE or BSE

Use brokers who are SEBI-registered and FEMA-compliant

Avoid sending money to foreign brokers just to trade EUR/USD or USD/JPY

Check for RBI's authorized dealer list or SEBI’s registered broker database

If it feels “too easy,” it’s probably not legal. Stick with authorized brokers, trade INR pairs, and avoid those flashy platforms promising overnight gains. India does allow forex trading — just not the way Instagram ads want you to believe.

Ready to trade smart? Good. Because in India, trading smart also means trading legal.

RBI, SEBI, and How Forex Trading Is Regulated

RBI Guidelines on Forex Trading Under FEMA

The RBI keeps things tight when it comes to forex. Under the Foreign Exchange Management Act (FEMA), Resident Indians can only trade in currency pairs approved by RBI, and always through an Authorized Dealer.

What’s allowed?

Only Current Account Transactions are permitted under the Liberalised Remittance Scheme.

No room for Speculative Trading or sending money abroad for margin-based forex deals.

RBI-approved platforms like BSE and NSE are your safe zones.

If you’re wiring funds overseas to dabble in EUR/USD on some random app — yep, that’s against FEMA.

SEBI Rules for Online Retail Traders in India

Only brokers registered with the Securities and Exchange Board of India (SEBI) can offer forex services to Indian residents.

These brokers must list on regulated exchanges like the National Stock Exchange (NSE) or Multi Commodity Exchange (MCX).

Margin Trading? Yes, but only within SEBI's investor protection framework.

“Compliance is not just policy — it’s peace of mind. SEBI ensures transparency where it matters most.”

— N. Vyas, Lead Compliance Officer, Fxbee

Why does that matter? Because if something goes sideways, you can actually get help. Try doing that with an unregistered offshore broker!

Permitted Currency Pairs Like EUR/USD and GBP/USD

Trading INR-based pairs is your legal green light. Want to explore EUR/USD or USD/JPY? Here’s what’s allowed on Indian exchanges:

| Currency Pair | Base Currency | Quote Currency | Exchange-Traded? |

|---|---|---|---|

| USD/INR | USD | INR | ✅ NSE, BSE |

| EUR/USD | EUR | USD | ✅ NSE (cross-currency) |

| EUR/INR | EUR | INR | ✅ NSE, BSE |

| GBP/USD | GBP | USD | ✅ NSE (cross-currency) |

| USD/JPY | USD | JPY | ✅ NSE (cross-currency) |

| GBP/INR | GBP | INR | ✅ NSE, BSE |

Stick to Exchange-Traded Derivatives and avoid Cross-Currency Pairs offered by unauthorized platforms. Those flashy dashboards won’t mean a thing when you can’t withdraw your funds.

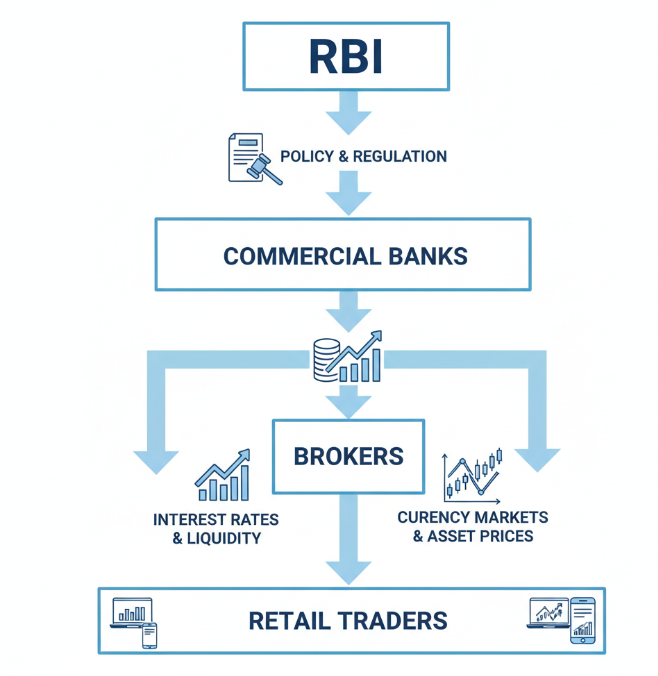

How Central Banks and Commercial Banks Shape Regulations

It’s not just about rules — it’s about financial stability. The Reserve Bank of India (RBI) plays conductor for India’s forex orchestra, while commercial banks handle the instruments.

Here's how it flows:

RBI sets Monetary Policy and oversees the Interbank Market.

The goal? Liquidity Management and keeping Forex Reserves strong.

Everything is backed by the Banking Regulation Act.

Commercial banks follow these signals, which trickle down to you. So when RBI tweaks a policy, even retail traders feel the ripple effect.

How CPI, GDP, Interest Rates, and Non-Farm Payrolls Guide RBI Policy

When the Consumer Price Index jumps, or Gross Domestic Product slows, the RBI steps in — often adjusting the Repo Rate to stabilize the economy.

3 things RBI watches like a hawk:

Inflation Targeting using CPI and Wholesale Price Index (WPI).

Monetary Policy Committee meetings — key interest rate announcements.

Global moves like the U.S. Non-Farm Payrolls, which influence INR indirectly.

These Economic Indicators aren’t just for economists. If you're trading USD/INR or JPY/INR, the numbers could mean a spike — or a wipeout — depending on how you’ve set your stop loss. So yeah, stay sharp.

Offshore Platforms vs. Legal Forex Brokers in India

Account Opening and KYC

Offshore platforms often let you open an account with nothing more than an email — no ID, no questions, no rules. Sounds easy, right? That’s the red flag.

Legal forex brokers in India follow strict SEBI regulations, which require:

PAN card and Aadhaar verification

Bank statement matching the trading account

Video KYC to prove you're a Resident Indian

Why it matters: Without FEMA compliance, trading with foreign brokers could trigger scrutiny or penalties.

???? If it feels too easy to sign up — you might be doing something very risky.

Leverage, Margin Call Policies

You think 1:500 leverage is a dream? It’s often a trap. Let’s break down the real differences in leverage policies between legal and shady brokers:

| Broker Type | Max Leverage | Margin Requirement | Stop-Out Level | Regulator |

|---|---|---|---|---|

| SEBI-Regulated | 1:20 | 5% | 50% | SEBI |

| Offshore (Unregulated) | 1:500+ | 0.2% | 20% or less | None or vague |

| ECN Institutional | 1:100 | 1% | 40–50% | Global Tier-1 |

Higher leverage = higher risk of margin call

SEBI limits keep retail traders from blowing their equity overnight

Unregulated brokers offer dream-like leverage, then watch you hit the stop-out level fast

???? As Arjun Mehra, Senior Compliance Officer at Fxbee, puts it:

"Any broker that offers 1:1000 leverage and doesn't care about your balance is betting against you. Literally."

Order Execution and Stop Loss

Here’s the kind of nonsense that happens with dodgy offshore platforms:

You place a market order, but nothing fills — hello, requotes

Your stop loss gets ignored during CPI news

Slippage always works against you, never for you

⚠️ Legit brokers (especially those tied to NSE or MCX-SX) follow strict execution standards:

Instant execution, not “we’ll see when we get to it”

Transparent spread structure

Well-documented limit order behavior

If your stop loss never hits where you expect it to, you’re not trading — you’re gambling.

Market Makers and Liquidity Providers

Offshore brokers rarely tell you who’s behind the curtain — and that’s the issue.

Market makers at offshore desks may act as your counterparty — meaning they profit when you lose

Some brokers claim to be STP or ECN, but the lack of market depth tells another story

With legal brokers, liquidity often comes from Tier 1 banks via the interbank market, giving you tighter bid-ask spreads and more reliable fills

Want a hint? If your broker never shows live depth of market and only trades via a dealing desk, it’s probably not plugged into real liquidity.

Common Legal Risks of Unregulated Forex Trading

FEMA Violations From Trading Restricted Currency Pairs

The Foreign Exchange Management Act (FEMA) limits what Indian residents can do in forex markets.

Trading on offshore platforms in non-INR pairs (like EUR/USD) violates RBI guidelines.

Using unauthorized dealers instead of licensed brokers may trigger scrutiny by the Enforcement Directorate.

The LRS scheme permits only specific outward remittances — forex speculation isn't one of them.

Cross-currency pair trading (e.g., USD/JPY) from India is considered illegal unless done on recognized Indian exchanges.

If you’re trading on a fancy app without checking if it’s RBI-cleared, you're basically asking for trouble.

High-Leverage Scalping and Margin Call Traps

Traders get lured in by sky-high leverage ratios like 1:500, thinking more exposure equals more money.

They attempt scalping in volatile markets, but the capital can’t absorb sudden price swings.

Margin requirements get hit, triggering automatic liquidation — wiping out the account.

With equity drained, stop-out levels kick in, and boom — it’s game over.

Example Margin Trap Table

| Broker Type | Leverage Offered | Stop-Out Level | Margin Requirement |

|---|---|---|---|

| Regulated (India) | 1:10 | 50% | 10% |

| Offshore Broker A | 1:500 | 20% | 0.5% |

| Offshore Broker B | 1:1000 | 10% | 0.1% |

Too much freedom without a seatbelt = capital loss you didn’t see coming.

Unregulated Signal Groups Using RSI, Bollinger Bands, Ichimoku Cloud

Telegram signal groups that dish out "RSI-based entries" and Ichimoku setups may seem helpful, but they’re often run by non-SEBI registered entities. When these groups promise copy trading or trend-following “secrets” with no investment advisory license, you’re skating on thin ice. Many blindly follow technical indicators like Bollinger Bands and Fibonacci levels without understanding price action or volatility. The danger isn’t just financial loss — it’s legal exposure. Copying trades from unverified groups means you might be taking unauthorized investment advice.

“Most scams don’t start with greed — they start with trust in the wrong Telegram group.”

— Priya Menon, Compliance Analyst, Fxbee

Slippage, Hedging Misuse, Drawdown, and Account Freezing Risks

Slippage & Spread Widening

When volatility hits — say, during CPI or NFP — your stop loss may not work as expected. That's slippage.

Hedging Without Knowing Broker Rules

Some offshore brokers don’t allow opposite-direction hedging. You might get margin called even with positions “neutralized.”

Drawdown Risks

Large drawdowns due to poor risk management or fake “low-spread” promises can lead to equity curve crashes.

Account Freezes

Unusual activity in or out of Indian bank accounts can trigger freezes under PMLA — especially if the broker is unregulated.

Fraud, Arbitrage Schemes, and Legal Enforcement Actions

Ponzi & Binary Options: Scammers promise guaranteed profits via binary options or arbitrage strategies.

Fake Arbitrage Explained: You invest in a scheme that “buys EUR/USD from Broker A and sells to Broker B” for a spread profit. Sounds genius. It’s not.

Regulatory Crackdown: Offshore brokers that push these schemes often face shutdowns, leaving users stuck with empty dashboards.

Cybercrime Teams Watching: The more organized your transfers look, the more likely cybercrime teams will link it to illegal remittance or money laundering.

Prosecution Risk: Once you’re flagged, even unintentional involvement can result in legal notice, scrutiny, or worse — prosecution.

It’s not just losing your deposit — it’s dealing with the Enforcement Directorate knocking on your door.

How to Check If a Forex Broker Is RBI-Compliant

Verifying RBI and SEBI Registration of Forex Brokers

The absolute bare minimum of trading safely in India is verifying if your broker’s got the green light from the Reserve Bank of India and SEBI under the FEMA Act.

Look for a valid License Number issued by a registered Authorized Dealer (AD-I).

Don’t trust claims like “RBI compliant” unless you find the broker listed on official RBI or SEBI portals.

A shady broker won’t survive a quick compliance check, so do the homework before funding that account.

“Regulation isn’t a checkbox — it’s a firewall between safety and chaos.”

— Rishabh M., Fxbee Compliance Officer

Checking Allowed EUR/USD, GBP/USD, and EUR/JPY Trading

Currency pairs are the heart of forex, but not all pairs are green-lit in India.

Stick to exchange-traded derivatives through NSE, BSE, or MCX-SX.

Make sure the platform supports only permitted currency pairs like USD/INR, or INR-crosses.

If a broker offers unrestricted EUR/USD, GBP/USD, or EUR/JPY with margin, and they’re offshore, that’s a ????.

Cross-check broker claims against RBI circulars — "Cross-currency" doesn’t mean “crossing the law.”

Confirm if settlement is routed via approved Indian exchanges.

Reviewing Leverage, Position Sizing, and Risk-to-Reward Limits

You don’t want your money disappearing faster than a TikTok trend. Brokers with wild leverage ratios might seem cool—until you hit a margin call.

✅ Key Review Points:

Margin requirements: Are they realistic, or gambler-level?

Lot size: Can you adjust it to suit your capital adequacy?

Risk Management tools: Position limits, alerts, automated cutoffs.

Exposure monitoring: Does the platform help you stay under control, or push you over the edge?

Here’s a simple reference table:

| Broker Name | Max Leverage | Min Lot Size | Position Limit |

|---|---|---|---|

| FxIndiaSecure | 20:1 | 0.01 | ₹5,00,000 |

| InstaTradeAsia | 100:1 | 0.01 | Unlimited |

| SEBI FX Trader | 30:1 | 0.1 | ₹10,00,000 |

If the broker lets you risk your whole account on a single AUD/USD trade? Run.

Assessing Market Orders, Limit Orders, and Stop Loss Tools

Trading platforms aren’t just for flashy charts. They better work when it counts.

Order Types like market orders, limit orders, stop orders, and trailing stops should be easy to place and clear in execution.

Look out for slippage during volatile moves, especially during releases like CPI or GDP.

Good brokers help you manage risk using stop loss and take profit tools — no guessing games.

Bonus if they’ve got price alerts tied to price action setups or liquidity heatmaps.

If your EUR/JPY stop loss gets skipped and nobody explains why? That’s a platform problem.

How Investment Banks and Prime Brokers Safeguard Client Funds

The safety of your money isn’t just about trading wins — it’s about where your funds live.

Reputable brokers use segregated accounts and send your money to Tier 1 Banks.

Look for names like HSBC, Citibank, or other verified custodians — not weird e-wallets.

Funds should be shielded from broker debts via capital protection policies.

If you’re dealing with a prime broker, check how they handle counterparty risk.

Some brokers also partner with liquidity providers to ensure financial security during high-volume events like Non-Farm Payrolls.

If withdrawals start taking days and excuses pile up, it’s time to exit — no matter how flashy the broker’s website is.

Tax Rules for Forex Trading Profits in India

Classifying Day Trading and Swing Trading Income

Forex profits can fall into different tax buckets based on how you trade. Sounds simple, but it’s actually where many traders mess up.

Intraday trading often falls under speculative income as per the Income Tax Act, taxed at slab rates.

Swing trading, if held for more than one day, usually qualifies as non-speculative business income.

If you're trading for long-term investment and not as a daily hustle, it might qualify for capital gains, but this is rare in forex.

To stay safe, consider treating all forex trades as business income and maintain proper books.

Understanding this keeps you out of tax trouble—and trust us, that’s worth it.

Recording Equity, Free Margin, and Drawdown for Tax Audits

Keeping tight records is not just good practice—it’s your shield in a tax audit under Section 44AB. Here’s how to keep it clean:

| Metric | What It Tells the Taxman | Source Document | Who Reviews It |

|---|---|---|---|

| Equity | Overall account value | Brokerage statement | Chartered Accountant |

| Free Margin | Available trading buffer | Trading dashboard | Internal finance team |

| Drawdown % | Risk exposure and capital erosion | Account performance log | Auditor during tax review |

| Monthly Summary | Income consistency | Broker CSV export | CA + Tax consultant |

Make sure your brokerage statement reflects these metrics clearly. When paired with risk management logs—like screenshots of stop-losses or margin calls—you’ll be ready for any scrutiny.

Reporting Profits From EUR/USD and USD/JPY Positions

So you booked gains trading EUR/USD and USD/JPY? Congrats—but now the taxman wants a word. Here’s your 3-step reality check:

Match your profits to RBI-compliant platforms. If trades happened via NSE or BSE in currency derivatives, you're good. Offshore? Not so much—those may violate the FEMA Act.

Convert gains to INR using the official RBI exchange rate on the settlement date.

Disclose profits under ‘business income’ in your return if trading regularly. Long-term positions could—rarely—qualify under capital gains.

???? “Profit is good, but documented profit is better. We always advise our clients to align reporting with RBI guidelines to avoid penalties.”

— Rahul Mehta, Senior Tax Advisor, Fxbee India

Using Trade Balance and GDP Announcements in Documentation

Got a strategy that reacts to the GDP or trade balance numbers on the economic calendar? Great—now prove it. Why?

Including macroeconomic notes like "Entered USD/JPY long based on falling Japanese GDP" gives your documentation legitimacy.

Audit trails that mention fundamental analysis help position your trading as structured, not speculative chaos.

Annotated logs during events like PMI or unemployment rate releases strengthen your case during assessments.

Traders who tie their actions to real macroeconomic data don’t just trade smarter—they defend smarter too.

Conclusion

Let’s cut to the chase — yes, forex trading can be legal in India, but only if you play by the rules. It’s not some free-for-all game where you can sign up on any flashy app and start buying USD/JPY before breakfast. The RBI and SEBI have a say in how, where, and what you trade, and ignoring that? That’s how people get burned.

Stick to these essentials:

Use brokers registered with SEBI, not some random site with no address.

Trade only the currency pairs the RBI/SEBI framework allows on Indian exchanges (think USD/INR, EUR/INR, GBP/INR, JPY/INR — plus exchange-traded cross-currency contracts like EUR/USD, GBP/USD, and USD/JPY where available).

Keep your trading records clean — income, taxes, the whole deal.

Don’t fall for “get-rich-quick” gurus tossing around fancy words like RSI or MACD.

For folks trying to make smart money moves, this isn’t just about chasing charts. It’s about staying clean, staying sharp, and keeping your wallet safe.

References

About Currency Derivatives - https://www.nseindia.com/products-services/about-currency-derivatives

SEBI Recognised Intermediaries - https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognised=yes

Foreign Exchange Management Act, 1999 (FEMA) - https://www.indiacode.nic.in/bitstream/123456789/1988/1/A1999_42.pdf

RBI FAQs: Forex Transactions / Derivatives - https://www.rbi.org.in/commonman/english/scripts/FAQs.aspx?Id=3347

RBI FAQs: Liberalised Remittance Scheme (LRS) - https://www.rbi.org.in/commonman/english/scripts/FAQs.aspx?Id=1834

BSE Currency Derivatives Page - https://m.bseindia.com/currency.aspx

MSEI Currency Derivatives Products - https://www.msei.in/products/currency-derivatives/default

SEBI Currency Derivatives Curation - https://www.sebi.gov.in/curation/currency_derivatives.html

Income Tax Act: Section 44AB - https://incometaxindia.gov.in

Speculative Income (Income Tax Act Section 43(5) explainer) - https://cleartax.in/s/speculative-income

Employment Situation Summary (Non-Farm Payrolls) - https://www.bls.gov/news.release/empsit.nr0.htm

Directorate of Enforcement (ED) - https://enforcementdirectorate.gov.in/

FAQ

What are the legal ways to do forex trading in India?

Use Indian brokers registered with SEBI.

Stick to INR pairs like USD/INR or EUR/INR.

Offshore sites offering pairs like EUR/USD? That’s a red flag.

Don’t send money abroad to trade unless RBI says it’s okay.

Why do people say some forex apps are illegal in India?

Most popular apps let you trade foreign pairs like GBP/USD or AUD/USD with high risk. But if you're in India, that kind of trading is off-limits. RBI doesn’t allow sending money abroad just to speculate.

How can I check if a forex trading platform is legit?

Is it listed on SEBI’s site? If not, nope.

Does it only offer INR-based pairs?

Are stop-loss and limit orders clearly shown?

Are your funds held with well-known banks?

Too-good-to-be-true leverage or signals? Walk away.

What can go wrong if I use an unregulated forex broker?

A lot, honestly. Your stop loss might not trigger. Your money could get stuck. Some shady platforms even freeze accounts during news events like NFP or interest rate drops. And if you mess with FEMA rules, tax trouble isn’t far behind.

What forex trading strategies are safest for Indians?

Swing or position trading on NSE-approved INR pairs.

Using tools like MACD or Moving Average, not just hype.

Sticking to stop-loss limits, no overtrading.

Staying away from signal groups that promise fast wins.

How are forex trading profits taxed here?

Most traders fall under business income tax if they’re active. Keep your account logs—things like equity and drawdown matter. If you're trading around CPI or GDP announcements, track it clearly. Helps if tax folks come knocking.