In the forex world, the forex spread isn’t just small talk—it’s the quiet killer or silent winner behind every trade. If you’re running a brokerage or shopping for liquidity solutions, spreads can make or break your bottom line faster than you think.

Think of it like gas prices. One cent per gallon doesn’t sound like much… until you multiply that by millions of liters. In the same way, a “small” spread can be the difference between profit and pain.

Some pros just slap on a markup and hope for the best. But as Marcus Tran, FXBee's Senior Product Manager, puts it: “Smart brokers don’t guess—they engineer every pip with intent.”

You’ll need to figure out when fixed spreads make sense, when variable spreads offer better client value, and how to avoid shady liquidity setups that drain your clients through the cracks. Clients can smell unfair pricing from a mile away.

This guide breaks it down without fluff. You’ll walk away knowing how spreads work, why they matter, and how to stay sharp in a game where every pip counts.

How does forex spread affect your profits?

Bid, Ask, and the Real Cost of Execution

Let’s start with basics—because this is where most people underestimate the cost.

When you see a quote like:

EUR/USD – 1.1050 / 1.1052

Bid price is 1.1050 (what the market pays you to sell).

The Ask price is 1.1052 (what you must pay if you want to buy).

That difference — usually a few pips — is the spread.

If you buy at 1.1052 and the price doesn’t move, and you instantly sell at 1.1050:

You’ve already lost 0.2 pips, just to enter and exit.

Scale that across lot sizes, multiple trades, and hundreds of clients… and the math gets brutal.

Spread as a Built-in Transaction Cost

You can think of spread as a silent transaction fee built into the price:

It reduces your profit on every winning trade.

It increases your loss on every losing trade.

It directly affects scalpers, day traders, and high-frequency strategies the most.

If your strategy is targeting 5–10 pips per trade, a 2-pip spread versus a 0.5-pip spread is the difference between:

A viable system

A beautiful idea that fails in live markets

For brokerages, every tenth of a pip matters when quoting spreads at scale.

What is a good spread in forex?

There’s no single “good” spread that works for everyone. A good spread depends on:

The currency pair

Current liquidity conditions

Trading session

Your business model (B-book, A-book, hybrid, ECN)

But we can still talk about healthy ranges industry-wide.

Typical Spread Ranges by Pair Type

Under normal market conditions:

| Pair Type | Example | Avg. Spread (Pips) | Liquidity Rating |

|---|---|---|---|

| Major pairs | EUR/USD | 0.5 – 1.5 | High |

| Minor pairs | EUR/GBP | 1.5 – 3.0 | Moderate |

| Exotic pairs | USD/TRY | 5.0 – 12.0 | Low |

Major pairs like EUR/USD have crazy-tight spreads

Exotic pairs will almost always be more expensive to trade and quote

If you’re seeing 3–4 pips on EUR/USD under normal liquidity? Something is off—either your liquidity source is weak, or there’s a markup party happening behind the scenes

For serious traders and institutional clients, tight, consistent spreads are a trust signal. For a broker or liquidity provider, it’s a competitive weapon.

Types of spread in forex

1. Fixed Spreads

Fixed spreads don’t change (much) regardless of market volatility. They’re often offered by:

Market makers

Retail-focused brokerages

Platforms optimized for predictability, not raw institutional execution

Pros:

Clients know costs in advance

Good for beginners who hate surprises

Easier marketing: “Trade EUR/USD from 1.5 pips fixed!”

Cons:

Brokers must pad in enough margin to survive volatile moves

Often wider than the best available variable spreads

Can result in re-quotes or execution delays when things get wild

2. Variable (Floating) Spreads

Variable spreads change with market conditions. Tight in high liquidity, wider when things get crazy.

Usually seen on:

ECN/STP models

Institutional feeds

Aggregated liquidity pools

Pros:

Ultra-tight spreads during normal trading conditions

More reflective of true market conditions

Attractive for active traders, arbitrage systems, and algos

Cons:

Can spike during news events or thin sessions

Harder to “promise” a specific spread in marketing

Requires good communication with clients about risk and slippage

3. Raw Spread + Commission Model

This model exposes almost raw interbank spreads and charges a commission on top.

Typical structure:

Spreads: 0.0 – 0.3 pips on majors

Commission: e.g., $6–$7 per round turn per standard lot

Why pros like it:

Transparent pricing

Ideal for scalping, high-frequency systems, and copy trading

Straightforward to model in backtesting

But if you’re running a brokerage, this model requires:

Good institutional relationships

High-quality liquidity aggregation

Tight risk controls against toxic flow and arbitrage

How Volatility Impacts Spread Behavior

When markets are calm, spreads behave. When markets panic, spreads explode.

How Volatility Impacts Profitability

Volatile markets = bigger spreads. Here's what that means:

Economic news events shake up liquidity like a snow globe, widening spreads like crazy.

Sudden price action can trigger stop-loss orders with more slippage than you’d expect.

Smart risk management means accounting for spread widening before placing large trades.

Watch the volatility index (VIX) — it's your early warning system.

No joke: some traders lose more on surprise spreads than the market move itself.

“If you’re not pricing volatility into your spread risk, you’re not managing risk at all—you’re just hoping the market behaves,” says Elena Moras, Head of Execution at Fxbee.

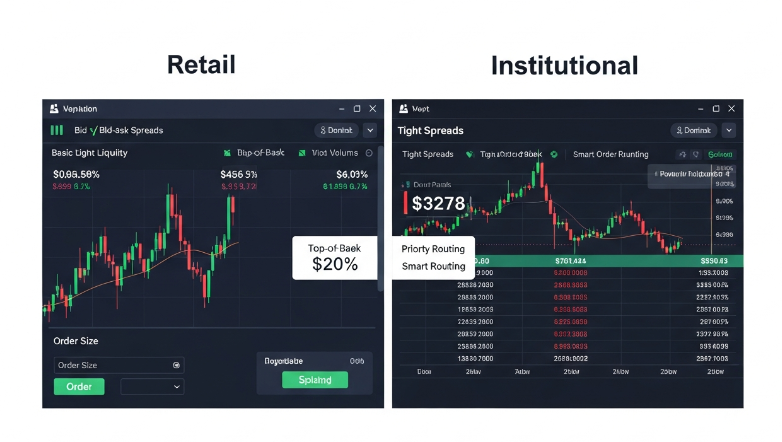

Retail vs. Institutional Spread Behavior

Retail clients usually see:

Wider average spreads

Fewer liquidity providers behind the scenes

More impact from markups and platform fees

Institutional or high-volume clients often get:

Priority routing

Deeper liquidity pools

Tighter spreads, especially on majors and high-volume pairs

If you’re designing pricing tiers, it makes sense to reward:

Higher volume

Consistent flow

Less-toxic order profiles (not all flow is equal)

Session-Based Spread Behavior

Spreads typically behave differently depending on the trading session:

During Asian session: spreads can be naturally wider, especially on European crosses.

During London session: deepest liquidity, tighter spreads on EUR, GBP, CHF, and related crosses.

During New York session: great liquidity on USD pairs, especially during overlap with London.

Spreads tend to be most favorable during the London–New York overlap—spreads are sharp, orders fill fast.

Spread behavior isn’t constant. If you're quoting client pricing or structuring your own white-label or brokerage offering, you need to model how spreads move throughout the trading day—not just at one snapshot in time.

Spread and Liquidity: Why They’re Joined at the Hip

Liquidity 101 (Without the Jargon)

Liquidity answers one simple question:

“How easily can you get in and out of a position without moving the market?”

In deep, liquid markets:

You get tight spreads

You see large volumes at each level

Slippage is lower, even on big orders

In thin or fragmented markets:

Spreads widen

Large orders can “walk the book”

Slippage increases, especially during volatile periods

The Spread-Liquidity Loop

Spreads and liquidity reinforce each other:

More liquidity → tighter spreads → more trading activity

Less liquidity → wider spreads → traders back off

If you're a brokerage, your job is to curate liquidity so that:

Your best clients get reliable execution

Your risk desk doesn’t get ambushed by unexpected one-sided flow

Your spreads stay competitive without killing your margins

Cross-Currency Arbitrage and Spread Optimization

Some call it nerdy, but triangular arbitrage is where the big brains and fast tech meet. Let’s break it down:

Currency pairs like EUR/JPY, USD/EUR, and JPY/USD often show small exchange rate mismatches.

These price discrepancies, even if they’re just a few basis points, open the door for risk-free profits.

The trick? Lightning-fast execution speed and ultra-low spreads.

Market inefficiency is the arbitrageur’s playground—but fat spreads slam the door shut before the fun begins.

Average Spread Impact on Arbitrage Viability

| Currency Pair | Avg Spread (pips) | Arbitrage Viability | Avg Execution Window (sec) |

|---|---|---|---|

| EUR/USD | 0.8 | High | 1.2 |

| GBP/JPY | 2.4 | Medium | 2.0 |

| NZD/CAD | 3.1 | Low | 2.5 |

If your brokerage spreads are bloated, you’re waving goodbye to easy profits.

Central Bank Events and Spread Risk

Interest rates can be a buzzkill. Here’s why spreads blow up like fireworks during monetary policy decisions:

Liquidity providers pull back—liquidity dries up like a puddle in the sun.

Spread widening hits hard, especially right before and after an FOMC announcement.

Slippage becomes brutal—market orders may fill multiple pips away from expected levels.

An economic calendar should be your best friend—timing matters.

So if you’re managing institutional flow, watching market volatility around rate decisions isn’t optional—it’s survival.

The cost you don’t always see

Hidden Charges That Bite Into Your Bottom Line

Most traders only notice the visible spread. But under the hood, there are more landmines:

Slippage: Happens when trades don’t fill at your expected price. It's worse during volatility spikes or low liquidity conditions.

Transaction costs: Beyond the spread, many forex brokers stack fees like platform charges, data feeds, or markup layers that aren't clearly advertised.

Round-turn commissions: On some platforms, it’s not just one way—you’re paying to get in and out.

Swap/rollover: Overnight financing charges can dwarf what you saved on tight spreads.

If you’re a broker or liquidity reseller and you’re not transparent about these, your sophisticated clients will notice. And they’ll leave.

If you’re on the buy-side, you should be asking:

What’s my true all-in cost per million traded?

Are my effective spreads wider than what’s marketed?

Am I getting fair price improvement, or always filled at the worst tick in the range?

How brokers really make money from spread

Let’s lift the curtain.

Brokers typically make money through:

Spread markups (adding a pip or fraction on top of their raw liquidity feed)

Commissions (fixed cost per million or per lot)

Order flow arrangements (with liquidity providers or prime brokers)

Markup vs. Commission

Some brokers:

Show you a tight spread and charge a commission.

Others show “zero commission trading” but with a wider spread.

From a business standpoint, both can yield similar revenue per million traded. But from a client trust standpoint, transparency wins.

The most sophisticated clients will ask for:

Raw spread + commission quotes

Full breakdown of liquidity providers and routing logic

Historical execution quality reports

What should you do?

You’re not just buying spreads. You’re buying execution, transparency, and trust. So when choosing a forex broker—especially for wholesale needs—make sure they’re upfront about:

Who their liquidity providers are

What kind of market maker or STP/ECN model they operate

How they handle news events, off-market hours, and extreme volatility

Whether they provide detailed reporting on effective spreads, slippage, and fill quality

Tight spreads look good in a banner ad. But smart traders—and good broker partners—know that:

Execution quality

Risk controls

And liquidity depth

matter just as much.

In a world where spreads are often a race to the bottom, the real edge comes from:

Pairing fair spreads with robust execution tech

Providing clear, no-nonsense trade cost reporting

Building partnerships where both sides can win over the long run

Because spreads aren’t just numbers on a screen—they’re a language. And if you can read that language in detail folks, it’s the difference between breaking even or bleeding out slowly over thousands of trades.

Here’s a quick gut check if you're sizing up spread-related costs or offerings:

Fixed spreads give peace of mind, but might cost more in the long run.

Volatile markets? Expect spreads to stretch wider than a Monday morning traffic jam.

Exotic pairs = bigger spreads = bigger risks.

The cheapest option isn’t always the smartest—watch for hidden mark-ups.

All said, don’t just chase tight numbers—chase clarity.

That’s where the smart money is.

FAQ

What is a forex spread and how is it calculated?

The spread is the difference between the bid price and the ask price.

It’s usually measured in pips for most currency pairs.

Liquidity providers and market makers are the main forces that shape the raw spread.

Brokers may add a mark-up to the raw spread or charge a separate commission.

Why does the forex spread affect long-term profitability?

Spreads act like a built-in transaction cost on every trade. Each time you open a position, you start slightly negative by the amount of the spread.

For high-volume or frequent traders, these small costs add up quickly over hundreds or thousands of trades.

Wider spreads, plus any hidden fees or mark-ups, can noticeably reduce your long-term net returns.

What causes spreads to widen during news events?

After major economic announcements, prices can move sharply and unpredictably. To manage risk, liquidity providers and brokers often widen spreads. Common drivers include:

Sharp price moves right after economic releases.

Temporarily reduced liquidity from top-tier providers.

Major pairs reacting faster and more violently than minors or exotics.

High-impact events like interest rate decisions and NFP (Non-Farm Payrolls).

How can traders reduce forex spread costs?

You can’t avoid spreads completely, but you can minimise their impact by:

Trading during active market sessions (e.g. London or New York overlaps) when liquidity is highest.

Favouring highly traded major pairs over thin, exotic pairs.

Using limit orders where possible instead of pure market orders.

Comparing brokers for spread transparency and avoiding those with large, inconsistent mark-ups.

Which trading styles are most sensitive to spread size?

Some strategies live or die by the spread because they aim for small, frequent gains:

Scalping, where many quick trades target a few pips of profit.

Cross-currency arbitrage, where tiny price differences matter.

Retail traders with high leverage, where costs magnify quickly.

Algorithmic or bot trading that relies heavily on market orders.

Is forex spread different for major and exotic pairs?

Yes. Major pairs (like EUR/USD, GBP/USD, USD/JPY) usually have tighter spreads because they are traded more frequently and have deep liquidity.

Exotic pairs tend to have wider spreads since fewer participants trade them and prices can jump more quickly.

What hidden costs are related to spreads?

Beyond the visible spread, traders should watch for:

Slippage in fast-moving markets, where orders fill at worse prices than expected.

Extra mark-ups quietly added by some brokers.

Weekend gaps that move your real entry away from the quoted price.

Higher commissions or fees on large or high-frequency trades.

How do order types influence real trading costs?

Different order types interact with spreads and volatility in different ways:

Market orders can suffer from slippage when prices change quickly.

Limit orders give you more control over entry price but may not fill if the market moves away.

Stop orders can trigger in volatile, low-liquidity conditions and fill at worse levels than you planned.

How should brokers manage forex spread risk?

To protect both clients and themselves, brokers typically:

Work with reliable liquidity providers.

Monitor market depth and order book changes closely.

Adjust spreads proactively when major news is released.

Keep tight risk controls in thin or highly volatile markets.

What should wholesale buyers look for in a spread provider?

Institutional and wholesale clients should pay close attention to:

Transparent pricing with clearly defined mark-ups and fees.

Consistently tight spreads, even around key news releases.

Execution quality – low rejection rates and fast fills.

Clear policies on slippage and commissions for large or high-frequency orders.