If you’ve been thinking about scaling up with forex trading in India, you’ve probably run into more red tape than results. Between half-baked platform promises and confusing RBI rules, it’s hard to know what’s actually legit — especially when you're eyeing big-volume trades or brokerage services.

Here’s the deal: forex isn’t totally off-limits in India — but it comes with strings attached. The moment you go wholesale, you're not just playing a game anymore — you’re stepping into a space where one wrong move could cost you more than just money.

“Too many clients assume all global platforms are fair game — until compliance slaps them in the face,” says an Fxbee compliance engineer. “The rules are clear. The problem is, most traders don’t know where to look.”

This guide cuts through the confusion. No fluff, no guesswork. Just what’s allowed, what’s risky, and how to stay on the right side of the law.

If you’re planning to go big with forex — as a trader or broker — don’t wing it. Read this first.

Legal Status of Forex Trading in India: Explained Simply

Trading forex in India isn’t a free-for-all. It’s tightly governed. Here's the clarity every serious trader or broker needs.

Understanding the Foreign Exchange Management Act (FEMA)

FEMA 1999 was built to keep forex inflows and outflows in check.

Applies to Resident Indians and governs Current Account and Capital Account transactions.

Enforced by the Enforcement Directorate, so violations are no joke.

Sets the legal foundation for Liberalised Remittance Scheme (LRS) rules — essential for businesses moving money abroad.

???? If your brokerage plan ignores FEMA, you're already in hot water.

???? Tip: Stick to FEMA’s definitions of permissible use — it can keep your forex license dreams alive.

Role of Reserve Bank of India in Forex Control

When it comes to forex, RBI isn't just sitting in a control tower — it's flying the plane.

RBI = India’s Central Bank — it governs the Exchange Rate policy and intervenes in case of Currency Volatility.

Sets Regulatory Framework for Forex Reserves and trade-related remittances.

Approves and monitors Monetary Policy, which directly affects forex liquidity.

RBI’s Recent Forex Market Actions

| Date | Action Type | Impacted Pair | Objective |

|---|---|---|---|

| Aug 2023 | Dollar Sale | USD-INR | Control INR weakening |

| Oct 2023 | Market Intervention | EUR-INR | Reduce volatility |

| Dec 2023 | Rate Hike Alignment | All INR Pairs | Inflation control |

???? RBI isn’t watching — it's actively steering the forex market.

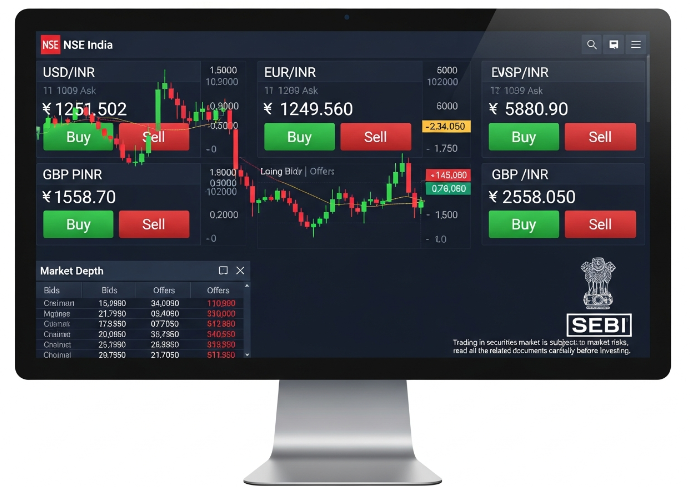

SEBI’s Jurisdiction in Exchange Traded Currency Derivatives

Want to trade on NSE or BSE using Currency Futures or Options? You’re in SEBI territory.

Securities and Exchange Board of India regulates all derivatives contracts traded on stock exchanges.

SEBI partners with Clearing Corporations to ensure trades are settled securely and transparently.

Only certain Futures Contracts are allowed — mostly involving INR-based pairs like USD-INR, EUR-INR.

???? Remember: Off-exchange contracts (like those on MetaTrader offshore platforms) are not SEBI-approved and won’t protect your capital.

???? “No SEBI oversight, no credibility — that’s our internal rule.” – Rahul Desai, FX Operations Manager, Fxbee

Who Can Trade? Authorized Dealer Category I Explained

Short on clarity? Let’s break down who’s legally allowed to get in on the action:

AD Category-I Banks: The big players. Think SBI, HDFC, ICICI – officially allowed to handle Foreign Exchange Transactions.

Authorized Persons: Smaller outfits or brokers with RBI approval under a specific license.

Money Changers & Financial Institutions: Also require a Banking License to handle client forex needs.

⚠️ Retail platforms operating without AD-I linkage are not permitted to offer real forex trading in India.

???? If you're setting up a brokerage, get tied to an AD-I bank or your business could be toast.

Restrictions on Spot Forex and Cross Currency Pairs in India

Here’s the straight truth — not all forex is legal in India.

Spot Market trading is prohibited for individuals unless routed via regulated exchanges.

INR-based currency pairs like USDINR, EURINR, GBPINR, JPYINR are allowed; but pairs like GBP-USD or EUR-USD? Not unless you're hedging via licensed channels.

Speculative Trading using Margin Trading models (like offshore MetaTrader platforms) = non-compliant.

???? Currency Derivatives via NSE/BSE are cool. Trading EUR-USD on a flashy app from Cyprus? Not so much.

Want to play it safe? Stay INR-aligned. Think compliance, not convenience.

RBI Guidelines vs. Actual Forex Platforms: What’s Allowed?

A lot of platforms say they’re safe for forex trading in India. But RBI’s rules say otherwise. Let’s unpack the reality and get you the facts.

Permitted Currency Pairs: INR-Based vs. Cross Currency

INR-based currency pairs like USDINR, EURINR, GBPINR, JPYINR are cleared for trading on Indian exchanges.

Cross currency pairs like EURUSD, GBPUSD, USDJPY are restricted for retail trading, but allowed on Exchange Traded Currency Derivatives (ETCD) under SEBI’s framework.

Most global forex platforms offer cross pairs by default, which can breach RBI’s restrictions.

Legal trading must happen through NSE or BSE and via SEBI-registered brokers.

| Currency Pair | Retail Trader Access | Allowed on Indian Exchange | SEBI-Regulated? |

|---|---|---|---|

| USDINR | ✅ Yes | ✅ Yes | ✅ Yes |

| EURUSD | ❌ No (Retail) | ✅ Yes (ETCD only) | ✅ Yes |

| GBPINR | ✅ Yes | ✅ Yes | ✅ Yes |

| USDJPY | ❌ No (Retail) | ✅ Yes (ETCD only) | ✅ Yes |

Liberalized Remittance Scheme and Forex Platform Limitations

Understand LRS: Under RBI’s Liberalized Remittance Scheme, Indian residents can send up to $250,000 abroad per year for Current Account Transactions like education or travel—not for Speculative Trading.

LRS Misuse: Many traders unknowingly violate LRS by using it to fund MetaTrader accounts or Offshore Brokers.

Tax Complications: From Oct 2023, TCS (Tax Collected at Source) applies on many LRS transactions, squeezing wholesale operations.

Platform Risk: FEMA prohibits Capital Account Transactions unless explicitly allowed—many platforms ignore this, which brings legal risk.

Net Open Position Limit and Risk Control Regulations

What’s NOPL?

The Net Open Position Limit is an RBI rule that restricts how much forex exposure traders (and brokers) can hold. It’s designed to reduce systemic risk in the Indian forex market.

Exposure Control:

Every Authorized Dealer must monitor clients’ Exposure Limits, ensuring they're not gambling with excessive leverage.

Margin Requirements Matter:

Brokers and institutional clients must lock margins before entering large trades. This prevents wild market swings.

Hedging with Limits:

If you're using forex for Hedging, you're still tied to NOPL limits—this keeps positions clean and legal.

“Too much open risk is a red flag. Every smart brokerage builds their risk policy around NOPL.” — Ravi P., Senior Risk Manager, Fxbee

Why Many Global Forex Platforms Are Not RBI-Compliant

Many international brokers operate through Electronic Trading Platforms (ETPs) like MetaTrader, offering leverage that violates Indian RBI circulars.

These platforms often allow Spot Forex and Cross Currency Pairs, which are not permitted for retail traders in India.

Using Offshore Brokers may trigger FEMA violations, and can attract scrutiny from the Enforcement Directorate.

Key reasons for RBI non-compliance:

High leverage ratios (often 1:500+) break Indian rules.

Many apps are banned or delisted by authorities.

Indian laws require Authorized Brokers with RBI & SEBI registration.

Tips:

Avoid offshore broker ads that target Indian users.

Stick with exchange-traded products regulated by SEBI.

How to Start Forex Trading Legally in India

Get your start in forex trading the right way—clean, compliant, and future-proof.

Choose an Authorized Broker with SEBI and RBI Approval

A legal start begins with a broker registered under SEBI and recognized by RBI—think NSE, BSE, or MCX-SX certified names.

The broker should be classified as an Authorized Dealer or a regulated stockbroker.

FEMA mandates limit forex to exchange-traded currency derivatives—spot trading? Off-limits in India.

“If your broker can’t explain their SEBI license, walk away.” — Rahul Menon, Sr. Compliance Officer at Fxbee

Setting Up a Forex Brokerage Partnership in India

Starting a brokerage with a legit partner isn’t rocket science—but it is structured:

Pick your model: Go as a Remisier, Sub-broker, or Authorized Person.

Partner up: Choose a main broker with terminal access and a clean track record.

Sign the deal: Look at franchise terms, revenue sharing, and client onboarding rules.

Focus on tools: You’ll need a powerful trading terminal and CRM to manage leads.

Build a funnel: Your job? Client acquisition. The better your outreach, the fatter your margins.

Registration, Documentation, and Compliance Requirements

This part might feel like a paperwork maze, but don’t skip it:

Start with PAN card, Aadhaar, and recent bank statement copies.

Fill out KYC and Demat/Trading Account forms via your chosen broker.

Ensure you're following FEMA Guidelines and PMLA anti-money laundering rules.

Documents are mandatory for both you and your clients—every transaction should be trackable and audit-ready.

Understanding Lot Size, Leverage Ratio, and Margin Requirements

Forex trading in India follows strict limits—but here's the good news: it's predictable.

Typical Currency Futures Setup on NSE:

| Currency Pair | Contract Size | Initial Margin | Max Leverage |

|---|---|---|---|

| USD-INR | $1,000 | ₹1,700 | ~20x |

| EUR-INR | €1,000 | ₹2,000 | ~18x |

| JPY-INR | ¥100,000 | ₹2,200 | ~15x |

Pip Value and Mark-to-Market settlement rules apply daily.

Always track your maintenance margin to avoid auto-squares.

High exposure? Keep an eye on those leverage ratios—profit's great, but risk is real.

Role of Market Makers and Liquidity Providers in Indian Forex

Quick bites on how big players move the game:

Market Makers: These are usually financial institutions who quote both sides—bid and ask—tightening the spread.

Liquidity Providers: Keep the order book flowing. No liquidity = dead market.

Clearing Corporation: Matches trades, settles contracts.

Arbitrage players: Jump in when prices differ across exchanges, helping maintain market depth.

Your clients benefit from tighter prices, lower slippage, and faster execution when counterparties are solid.

Currency Futures vs. Forward Contracts: Which is Allowed?

✅ Currency Futures (USDINR, EURINR): Allowed and traded on NSE & BSE. Ideal for hedging and speculation within FEMA limits.

❌ Forward Contracts: OTC deals between parties—not allowed for general traders unless cleared via Authorized Dealers.

Futures are exchange-traded, have an expiry date, and are settled via daily mark-to-market.

Forward contracts offer flexibility but don’t meet compliance standards for retail or most brokerage models in India.

Platforms You Can Use Without Breaking the Rules

You don’t have to risk everything on shady offshore platforms. These options keep it clean and legal in India.

Indian Exchanges Offering Currency Futures and Options

Want to trade USDINR or EURINR without ruffling any legal feathers? NSE, BSE, and MCX-SX have your back.

✅ NSE and BSE offer SEBI-regulated Currency Futures and Currency Options.

✅ Pairs like USDINR, EURINR, GBPINR, and JPYINR are fully permitted.

✅ All trades settle through clearing corporations, so you're dealing with zero counterparty risk.

✅ You won’t get access to exotic pairs, but you’ll stay fully compliant with Indian laws.

“Stick to what’s cleared by SEBI. No shortcuts. That’s how long-term brokerages win trust.” — N. Bhatia, Senior Product Manager, Fxbee

Onboarding Clients with SEBI-Approved Platforms

If you're in the brokerage biz, getting clients on Zerodha or Angel One is a no-brainer. Here's how to roll:

Ensure KYC is 100% complete — Aadhaar, PAN, and bank verification is non-negotiable.

Open Demat + Trading Account — Required for exchange-based forex like USDINR.

Tie up as a sub-broker or partner — Platforms like Upstox and Angel One offer custom solutions.

Monitor Compliance — SEBI regulations change fast, so keep your eye on updates.

Keep Brokerage Rates Transparent — It builds trust and keeps client churn low.

???? Pro Tip: B2B brokerages thrive on process clarity — onboarding should be fast, clean, and always audit-ready.

Currency Swaps and Derivatives Contracts via Banks

Now this one’s for the big boys. If you’re dealing with large volumes or corporate clients, it’s all about RBI-regulated banks.

Currency swaps, Forward Contracts, and Interest Rate Swaps are available through Commercial Banks authorized under FEMA and overseen by the RBI. These instruments allow for serious Hedging strategies, but you’ll need to work directly with Authorized Dealers (Category I) to access them.

Here’s a quick comparison table of what's available via banks:

| Instrument Type | Use Case | Regulated By | Typical Users |

|---|---|---|---|

| Forward Contracts | Hedging future payments | RBI/FEMA | Exporters, Importers |

| Currency Swaps | Managing interest & currency exposure | RBI | Institutions, Corporates |

| Interest Rate Swaps | Adjusting fixed/floating rates | RBI | Banks, Hedgers |

If you're planning wholesale brokerage services, this is where institutional-level trust meets compliance.

Taxes on Forex Trading in India

Who really wants a tax surprise? Here's what you should know if you're trading forex in India — especially if you're running a brokerage or handling large trades.

How Forex Trading Gets Taxed in India

There’s no one-size-fits-all rule. Your tax treatment depends on how you trade and how often.

1. Speculative Income

If you're placing short-term trades in Currency Derivatives (like futures or options) for your own gains without it being your core business.

Taxed under: Speculative Business Income

You may need to file a Tax Audit if your turnover crosses the limits under the Income Tax Act.

2. Business Income

Applies to brokerages, full-time traders, or prop trading firms where forex is the main source of revenue.

Allowed to deduct business expenses — including rent, salaries, tech tools, etc.

Required filings: ITR-3, possibly Tax Audit too.

3. Capital Gains

Rare for forex but can apply if you're passively investing in permitted Currency Derivatives with long holding periods.

Taxed under Capital Gains Tax, long-term or short-term depending on tenure.

Tax Breakdown Table for Forex Trading in India

| Category | Tax Type | Applicable Forms | Audit Requirement |

|---|---|---|---|

| Personal Speculative Trading | Speculative Business Income | ITR-3 | If turnover > ₹1 Cr |

| Brokerage or Prop Desk | Business Income | ITR-3 | Yes, in most cases |

| Long-Term Holding (Rare) | Capital Gains Tax | ITR-2 / ITR-3 | Usually not required |

What About FEMA and RBI Rules?

RBI and FEMA don’t tax you — but they control what’s legal to trade. If you're dealing with non-permitted currency pairs (like USD-JPY or EUR-USD) from offshore platforms, that’s a violation, and the tax department might just come knocking.

FEMA violations can trigger penalties or worse — and they don’t care if you paid tax on the gains.

Real Talk from the Industry

“A lot of new brokerages forget tax planning while focusing on setup. We’ve seen well-funded desks miss tax audit deadlines just because no one flagged the speculative income limits.”

— Anuj Rawat, Compliance Manager, Fxbee India

“Stick to INR-based pairs and SEBI-regulated Currency Derivatives. Anything outside that? It’s not just risky — it’s straight-up non-compliant from a tax AND FEMA standpoint.”

— Mira Sinha, Senior Legal Advisor, Fxbee

Pro Tips

Use accounting software that tracks mark-to-market and margin — it makes audits easier.

Don't ignore Bid-Ask Spread profits if you’re a liquidity provider — they count as income.

Trading through overseas platforms? You’re already in FEMA violation and tax non-compliance — that's double trouble.

Want to stay off the radar? Stick to RBI-permitted trades, keep your books clean, and always assume the taxman is smarter than your spreadsheet.

Need help structuring your forex brokerage’s taxes? Get a tax pro who knows Currency Derivatives and FEMA inside out.

Conclusion

If you’re eyeing the currency game from inside India’s borders, things aren’t as open as you might think—but they’re not shut tight either. The rules are more like a tightrope than a locked door. You’ve got to know who’s holding the rope—RBI, SEBI, and FEMA—and follow their lead. It’s not about walking away from forex; it’s about walking the right line.

Here’s the deal for anyone serious about forex trading in India, especially if you're in the wholesale or brokerage game:

Stick with INR-based currency pairs like USD-INR or EUR-INR

Only use Indian exchanges that offer Currency Futures or Options

Avoid offshore apps pushing spot forex and high-risk trades

If you're building a brokerage, register with an Authorized Dealer Category I

Keep tabs on economic triggers—like interest rate shifts or the trade balance

Bottom line? You can get into the forex business here—just don’t wing it. Play it clean, build it smart, and you won’t just stay out of trouble—you might build something that lasts.

References

[Income Tax Department of India – Official Portal - https://www.incometaxindia.gov.in]

[NSE – Currency Derivatives: Market Watch & Product Information - https://www.nseindia.com/market-data/currency-derivatives]

[NSE – Contract Specifications: Currency Futures & Options on INR Pairs - https://www.nseindia.com/static/products-services/currency-derivatives-contract-specification-inr]

[Reserve Bank of India – Official Website - https://www.rbi.org.in]

[RBI – Liberalised Remittance Scheme (LRS) FAQs - https://www.rbi.org.in/Commonman/English/Scripts/FAQs.aspx?Id=1834]

[RBI Press Release – Caution Against Unauthorised Online Forex Trading Platforms (ETPs) - https://www.rbi.org.in/Commonman/English/Scripts/PressReleases.aspx?Id=3369]

[RBI – FAQs on Foreign Exchange Facilities (FEMA Framework) - https://www.rbi.org.in/commonman/english/scripts/FAQs.aspx?Id=829]

[RBI Notification – Currency Futures in USD-INR, EUR-INR, GBP-INR and JPY-INR - https://www.rbi.org.in/commonman/english/scripts/Notification.aspx?Id=729]

[Securities and Exchange Board of India – Official Website - https://www.sebi.gov.in]

[SEBI Circular – Exchange Traded Cross Currency Derivatives on EUR-USD, GBP-USD and USD-JPY (2016) - https://www.sebi.gov.in/legal/circulars/mar-2016/introduction-of-exchange-traded-cross-currency-derivatives-contracts-on-eur-usd-gbp-usd-and-usd-jpy-currency-pairs_31858.html]

FAQ

Is forex trading in India legal for individuals and brokers?

Yes, it's allowed but tightly regulated. You can only trade INR-based currency pairs through platforms approved by the Reserve Bank of India and SEBI. Anything outside that could break FEMA rules.

What currency pairs are permitted for forex trading in India?

INR-based pairs only for retail use:

USD-INR

EUR-INR

GBP-INR

JPY-INR

Cross-currency pairs like EUR-USD allowed only on SEBI-regulated exchanges

What regulatory bodies oversee forex trading in India?

RBI handles foreign exchange rules under FEMA. SEBI controls currency derivatives on stock exchanges like NSE and BSE. For legal trading, you need to follow both.

Which financial instruments are legal in India’s forex market?

Currency Futures

Currency Options

Forward Contracts (hedging via banks)

Currency Swaps (used by large firms)

Spot forex is not allowed for retail traders

How can a business legally start forex trading in India?

Work with a licensed broker or an Authorized Dealer Category I bank. You’ll need documents, RBI-compliant exposure limits, and you must follow SEBI and FEMA rules.

What are the tax implications of forex trading in India?

Income is taxed as business or capital gains

GST may apply on commissions

Audit needed if turnover is high

TDS can apply in B2B payouts

Why are global forex platforms not allowed for Indian users?

Many offer products like Spot Forex or use high leverage—both banned by RBI. They also don’t operate under SEBI, so using them can lead to legal trouble.

What analysis methods are used in legal forex trading in India?

Fundamental analysis: Focus on GDP, inflation, rates

Technical analysis: Use chart patterns, stop-losses, trend signals

Sentiment analysis: Gauge market emotion from news and reactions

What platforms support legal forex trading in India?

Indian exchanges like NSE and BSE support INR-based pairs. You can trade legally through SEBI-approved brokers who follow RBI compliance rules.

What roles do brokers play in forex trading in India?

Connect you to regulated platforms

Offer liquidity as market makers

Support institutional clients with currency swaps or hedging tools

Stay compliant with SEBI and RBI